What Is Self-Employment Tax and Why It Matters in 2025

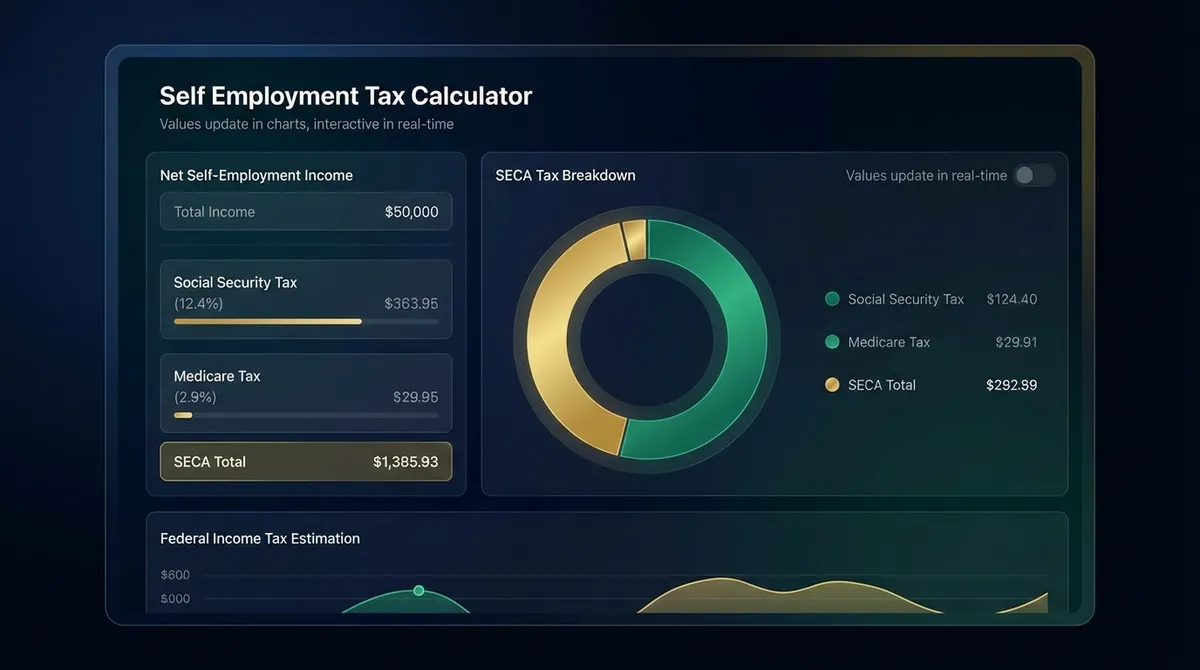

Self-employment tax is the Social Security and Medicare tax that self-employed individuals must pay on their net earnings. Known as SECA (Self-Employed Contributions Act) tax, it mirrors the FICA taxes that traditional employees have withheld from their paychecks. However, unlike employees who split these taxes with their employers (paying 7.65% each), self-employed individuals pay both portions—totaling 15.3% on their net earnings.

In 2025, self-employment income continues to surge as more Americans embrace freelancing, gig work, and entrepreneurship. With Social Security tax applying to earnings up to $176,100 and Medicare tax applying to all earnings (plus an additional 0.9% Medicare surtax for high earners), understanding your self-employment tax obligation isn't just tax compliance—it's essential financial planning that directly impacts your take-home income, estimated tax payments, and overall business profitability.

Key Statistic: A freelancer earning $80,000 with $15,000 in business deductions will owe $9,890 in self-employment tax in 2025—12.4% of their revenue. However, they can deduct $4,945 (half of the self-employment tax) from their federal income tax, reducing their taxable income to $60,055 and saving approximately $1,130 in income taxes, depending on their tax bracket.

How Self-Employment Tax Calculations Work: Breaking Down the 15.3%

Self-employment tax consists of two distinct components that mirror the Social Security and Medicare taxes paid by traditional employees. Understanding each component helps you plan for tax payments, maximize deductions, and avoid surprises at tax time.

Self-Employment Tax Formula (2025)

Total SE Tax = Social Security Tax + Medicare Tax + Additional Medicare Tax (if applicable)

Social Security Tax

12.4%

Applies to first $176,100 of net earnings

Maximum Social Security tax: $21,836.40 ($176,100 × 12.4%)

Medicare Tax

2.9%

Applies to all net earnings (no limit)

No wage base limit for Medicare portion

Additional Medicare

0.9%

Applies above income thresholds

Single: $200,000+ | Married: $250,000+

Calculating Net Earnings from Self-Employment

Before calculating self-employment tax, you must determine your net earnings from self-employment. This isn't simply your business revenue—it's your profit after business deductions multiplied by 92.35% (the adjustment factor that accounts for the fact that self-employed individuals can deduct the employer portion of self-employment tax).

Net Earnings Calculation: Net Earnings = (Business Revenue - Business Deductions) × 92.35%

- •Business Revenue: All income from your self-employment activities—1099 income, client payments, sales, etc.

- •Business Deductions: Legitimate business expenses like office supplies, equipment, software, marketing, professional services, home office, vehicle expenses, etc.

- •92.35% Adjustment: The IRS allows this reduction because self-employed individuals pay both employee and employer portions of the tax.

The SE Tax Multiplier Effect

The 92.35% adjustment creates a partial offset to the higher self-employment tax rate. For every $100 in net profit, you only pay SE tax on $92.35. Since the combined SE tax rate is 15.3%, your effective rate on your original $100 profit is approximately 14.13% ($92.35 × 15.3%). While still higher than the 7.65% employees pay, this adjustment provides some relief and recognizes that self-employed individuals bear both employer and employee tax burdens.

Real-World Example: Mark's Freelance Design Business in 2025

Meet Mark, a 34-year-old freelance graphic designer who left his corporate job two years ago to start his own business. In 2025, he's earned $85,000 from various clients (including several 1099s) and has $18,000 in legitimate business deductions for software subscriptions, equipment, home office, professional development, and marketing expenses.

• Business Revenue: $85,000

• Business Deductions: $18,000

• Net Profit: $67,000

• Tax Filing Status: Single

• Net Earnings for SE Tax: $61,825 ($67,000 × 92.35%)

• Social Security Tax: $7,666 ($61,825 × 12.4%)

• Medicare Tax: $1,793 ($61,825 × 2.9%)

• Additional Medicare: $0 (under $200,000 threshold)

• Total SE Tax: $9,459

• Deductible Portion: $4,730

Without the self-employment tax deduction, Mark would owe income tax on $67,000. However, by deducting $4,730 (half his SE tax), his taxable income drops to $62,270. In the 22% tax bracket, this saves him approximately $1,041 in federal income taxes. Mark makes quarterly estimated tax payments of $2,365 (25% of his SE tax) in April, June, September, and January to avoid underpayment penalties.

Key Insight: Mark's total tax burden (self-employment + income tax) is approximately $21,000, or 25% of his gross revenue. However, he keeps $64,000 (75% of revenue) compared to $62,400 (73% of salary) he kept as an employee earning $85,000, despite paying both portions of payroll taxes. The business deductions and self-employment tax deduction partially offset the higher tax rate.

💡 Expert Tips from Jurica Šinko to Minimize Self-Employment Tax Legally

1. Maximize Your Business Deductions: Above-the-line business deductions directly reduce your self-employment tax base since SE tax applies to net earnings, not gross revenue. Track every legitimate business expense—home office (up to $1,500 simplified method), vehicle mileage (67¢ per mile in 2025), professional development, software subscriptions, equipment, health insurance premiums (if self-employed), and retirement contributions. Use our tax deduction calculator to estimate savings.

2. Consider an S-Corporation Election: If your net earnings exceed $60,000-$80,000, electing S-Corp status can save thousands. You pay yourself a reasonable salary (subject to FICA taxes at 15.3%) then take remaining profits as distributions (not subject to SE tax). This can reduce overall tax burden but compare your brackets with our tax bracket calculator.

3. Make Quarterly Estimated Payments: Avoid underpayment penalties and April sticker shock by paying 25% of your expected SE tax each quarter. Use Form 1040-ES. You can check your obligations with our income tax calculator.

4. Deduct Half Your SE Tax: This above-the-line deduction reduces federal income tax (but not SE tax). In our example, the $4,730 deduction saved $1,041 in income taxes. Don't forget this often-overlooked benefit that softens the blow of paying both portions of Social Security and Medicare.

5. Time Income and Expenses Strategically: In high-earning years, accelerate deductions by prepaying expenses. See how the standard deduction impacts your filing. For official guidance, refer to the IRS Self-Employment Tax Center.

Top Tax Deductions for Self-Employed Individuals

Reducing your net earnings is the most effective way to lower your self-employment tax bill. Every dollar of legitimate business expense you deduct saves you approximately 15.3 cents in SE tax plus your income tax rate.

Home Office Deduction

Deduct $5 per sq ft (up to 300 sq ft) using the simplified method, or actual expenses (mortgage interest, utilities, repairs) based on the percentage of your home used exclusively for business.

Vehicle Expenses

Deduct 67 cents per business mile (2025 rate) or actual expenses (gas, insurance, repairs, depreciation) for the business portion of vehicle use.

Health Insurance

Self-employed individuals can deduct 100% of health, dental, and long-term care insurance premiums for themselves, their spouse, and dependents (Adjustment to Income).

Marketing & Advertising

Deduct costs for your website, domain hosting, business cards, online ads (Google/Facebook), networking events, and promotional materials.

Professional Services

Fees paid to accountants, lawyers, consultants, and contractors are fully deductible. Don't forget bank fees and credit card processing charges.

Startup Costs

You can deduct up to $5,000 of startup costs (market research, business formation fees) in your first year of business, subject to income limitations.

Frequently Asked Questions (FAQ)

Who has to pay self-employment tax?

Generally, you must pay SE tax and file Schedule SE (Form 1040) if your net earnings from self-employment were $400 or more. This includes freelancers, independent contractors, sole proprietors, and partners in a partnership. Even if you are receiving Social Security benefits, you still owe SE tax on your earnings.

Do I pay self-employment tax if my business lost money?

No. If your business has a net loss (expenses exceed revenue) or net earnings under $400, you generally do not owe self-employment tax. However, you still may need to file a tax return to claim the loss, which can offset other income you may have.

Is the self-employment tax deduction an itemized deduction?

No. The deduction for one-half of your self-employment tax is an "above-the-line" deduction (adjustment to income). You can claim it whether you take the standard deduction or itemize your deductions. This directly lowers your Adjusted Gross Income (AGI).

How does self-employment tax affect my Social Security benefits?

Paying self-employment tax earns you credits toward Social Security coverage. The more you pay in SE taxes on your earnings (up to the annual cap), the higher your potential future retirement, disability, and survivor benefits will be. It works exactly like the FICA taxes deducted from an employee's paycheck.

Can I pay SE tax in a lump sum at the end of the year?

You can, but you may face an underpayment penalty. The US has a "pay-as-you-go" tax system. If you expect to owe $1,000 or more in tax when you file, you are generally required to make estimated tax payments quarterly (April 15, June 15, Sept 15, Jan 15).