Simple Interest Explained: I = P × r × t

Simple interest is the most straightforward way to calculate the cost of borrowing money or the return on a short term investment. Instead of growing on top of previous interest, it applies the same percentage to the original principal for every period. The simple interest calculator on this page uses the standard formula I = P × r × t so that you can quickly see how much interest builds over a chosen time frame.

This approach is common on short term personal loans, some auto loans, and basic savings products that pay interest only on the original deposit. It is also a helpful teaching tool because it shows a straight line relationship between time, rate, and total interest, making it easier to understand how each input affects the final number.

The Simple Interest Formula (I = P × r × t)

The calculator applies the classic simple interest formula I = P × r × t. Each letter has a clear meaning:

- P (principal): The starting amount of money you borrow or invest.

- r (rate): The annual interest rate expressed as a decimal, so 6% becomes 0.06.

- t (time): The length of time the money is borrowed or invested, measured in years.

- I (interest): The total interest paid or earned over the full period.

Because simple interest does not compound, the interest amount increases in equal steps as time passes. Doubling the time doubles the interest, and doubling the rate has the same effect. That makes simple interest predictable but less powerful than compounding for long term investing.

How to Use the Simple Interest Calculator Step by Step

- Enter the principal. Start with the amount you are borrowing or investing. For example, 5000 for a five thousand dollar loan.

- Set the annual interest rate. Type the yearly rate as a percentage, such as 4 for 4%. The calculator converts it to a decimal behind the scenes.

- Choose the time and unit. Enter how long the money is borrowed or invested and choose whether that number represents years, months, or days.

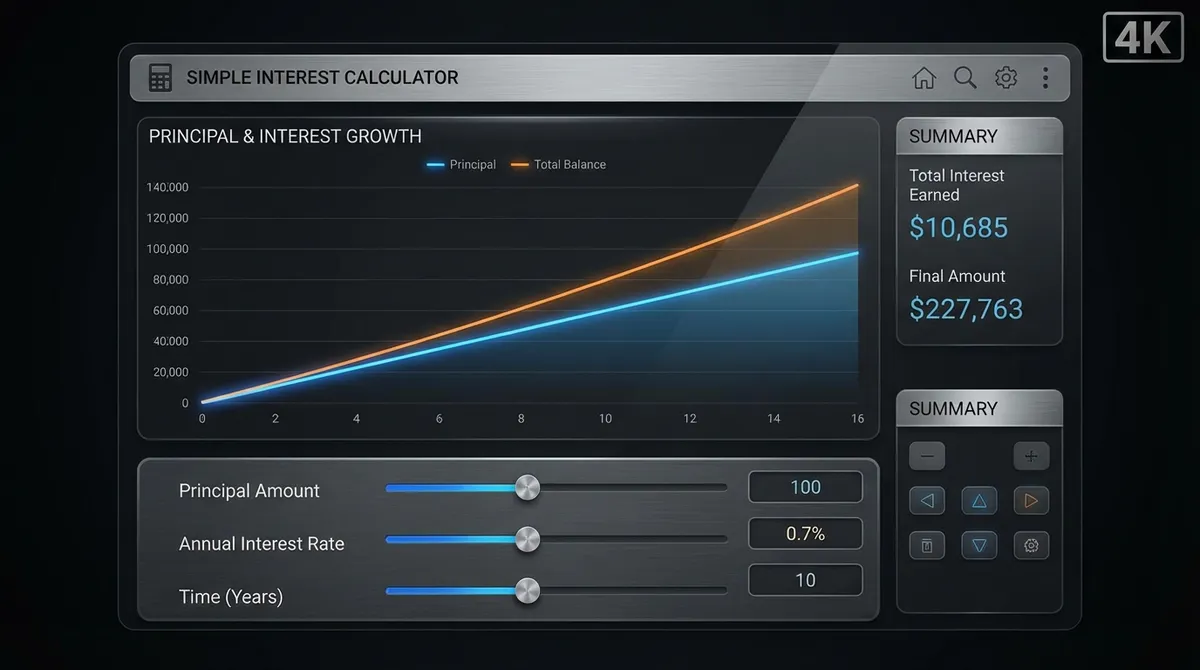

- Review the results. The output shows the total interest, the final amount (principal plus interest), and a breakdown chart of how the balance grows over time.

- Compare scenarios. Adjust the inputs to see how changing the rate or term affects your total cost or return.

Worked Examples of Simple Interest Calculations

Example 1: Three Year Personal Loan

Imagine you borrow 5,000 dollars at a simple annual interest rate of 4% for three years. In the formula, P = 5,000, r = 0.04, and t = 3. The interest is:

I = 5,000 × 0.04 × 3 = 600.

At the end of the term you repay 5,600 dollars in total: the original 5,000 dollar principal plus 600 dollars in interest.

Example 2: Six Month Short Term Investment

Now suppose you invest 1,200 dollars at 18% simple interest for six months. In years, time t is 0.5. The calculation becomes:

I = 1,200 × 0.18 × 0.5 = 108.

The final amount after six months is 1,308 dollars. The calculator handles this automatically when you choose months as the time unit and enter 6.

How to Interpret Your Results

When you run a calculation, focus on three key numbers: the principal you start with, the total interest, and the final amount. If you are borrowing, the final amount represents the total that must be repaid. If you are investing, it shows how much your money grows over the chosen period.

The chart in the calculator illustrates how the balance increases in a straight line over time. This linear pattern is the hallmark of simple interest. If you compare the simple interest result with the compound interest comparison shown below the chart, you can clearly see how compounding adds more growth over longer horizons.

For very short periods, such as a few months, the difference between simple and compound interest is usually small. Over many years, compound interest can add thousands of dollars of extra growth, which is why investors often prioritize accounts and products that compound.

Common Mistakes and Edge Cases to Watch

- Mixing up percentage and decimal. If you enter 0.06 instead of 6 for a 6% rate, the calculator will treat it as 0.06%, which drastically understates the interest.

- Ignoring the time unit. Entering 12 with the unit set to years is very different from entering 12 with the unit set to months. Always double check the selected unit before interpreting the result.

- Using simple interest for complex loans. Credit cards, mortgages, and many personal loans use compounding and amortization rather than simple interest. Use this calculator for clear, linear scenarios and switch to a dedicated loan calculator for more realistic repayment modeling.

- Relying on very high rates. Extremely high simple interest rates may signal risky lending arrangements. Always compare offers and understand the annual percentage you are agreeing to pay.

When Simple Interest is a Useful Approximation

Simple interest is most realistic for short term loans, promotional offers, and educational examples where the rate is fixed and the principal does not change during the period. It is also a convenient way to sanity check lender quotes. If a proposed loan cost is much higher than a basic simple interest calculation at the same rate and time, you know additional fees or compounding effects are involved.

Use this calculator as a quick planning tool. For more detailed scenarios, try our APR calculator for credit costs, auto loan calculator for vehicles, or business loan calculator for commercial financing. For savers, our savings goal calculator shows the power of growth. For a technical deep dive, verify the math on Wikipedia.

Simple Interest vs. Compound Interest: A Critical Comparison

Understanding the difference between simple and compound interest is fundamental to financial literacy. While simple interest is calculated only on the principal amount, compound interest is calculated on the principal plus the accumulated interest. This "interest on interest" effect causes money to grow exponentially rather than linearly.

Simple Interest Characteristics

- Growth is linear and predictable.

- Interest amount is constant each period.

- Formula: I = P × r × t

- Common in: Car loans, short-term personal loans, some bonds.

- Better for: Borrowers (generally results in less interest paid over time).

Compound Interest Characteristics

- Growth is exponential and accelerates.

- Interest amount increases each period.

- Formula: A = P(1 + r/n)^(nt)

- Common in: Savings accounts, investments, credit cards, mortgages.

- Better for: Savers and Investors (wealth grows faster).

For example, if you invest $10,000 at 5% for 20 years:

Simple Interest: You would earn $10,000 in interest (Total: $20,000).

Compound Interest (Annual): You would earn roughly $16,533 in interest (Total: $26,533).

The $6,533 difference shows the power of compounding over time.

Frequently Asked Questions (FAQ)

What is the formula for simple interest?

The formula is I = P × r × t, where I is the interest earned, P is the principal amount (initial investment or loan), r is the annual interest rate (as a decimal), and t is the time in years. To find the total amount (Principal + Interest), the formula is A = P(1 + rt).

How do I convert monthly rates to annual rates?

Simple interest formulas typically use an annual rate. If you are given a monthly rate (e.g., 1% per month), multiply it by 12 to get the annual rate (12%). Conversely, if you have an annual rate and need the monthly interest, divide the annual rate by 12.

Is simple interest better for borrowers or lenders?

Simple interest is generally better for borrowers because they pay interest only on the principal, not on the accumulated interest. This results in lower total payments compared to compound interest loans. Conversely, lenders and investors prefer compound interest because it maximizes their returns over time.

Can simple interest be calculated for days?

Yes. To calculate simple interest for a number of days, you typically divide the number of days by 365 (or sometimes 360, depending on the "day count convention" used by the bank). For example, for 45 days, 't' in the formula would be 45/365 ≈ 0.123 years.

What is the "Rule of 72"?

The Rule of 72 is a mental math shortcut to estimate how long it takes for an investment to double at a given fixed annual rate of compounded interest. However, for simple interest, the doubling time is exactly 100 / Interest Rate. For example, at 10% simple interest, money doubles in 100/10 = 10 years. (At 10% compound interest, it doubles in roughly 7.2 years).