Complete Guide: Understanding Your Paycheck in Every State (2025)

Your salary offer might look great on paper, but your "take-home" pay tells the real story. Where you live significantly impacts how much money actually lands in your bank account, thanks to the wide variety of state income tax laws across the US. Understanding the difference between gross pay and net pay is crucial for financial planning, budgeting, and evaluating job offers in different states.

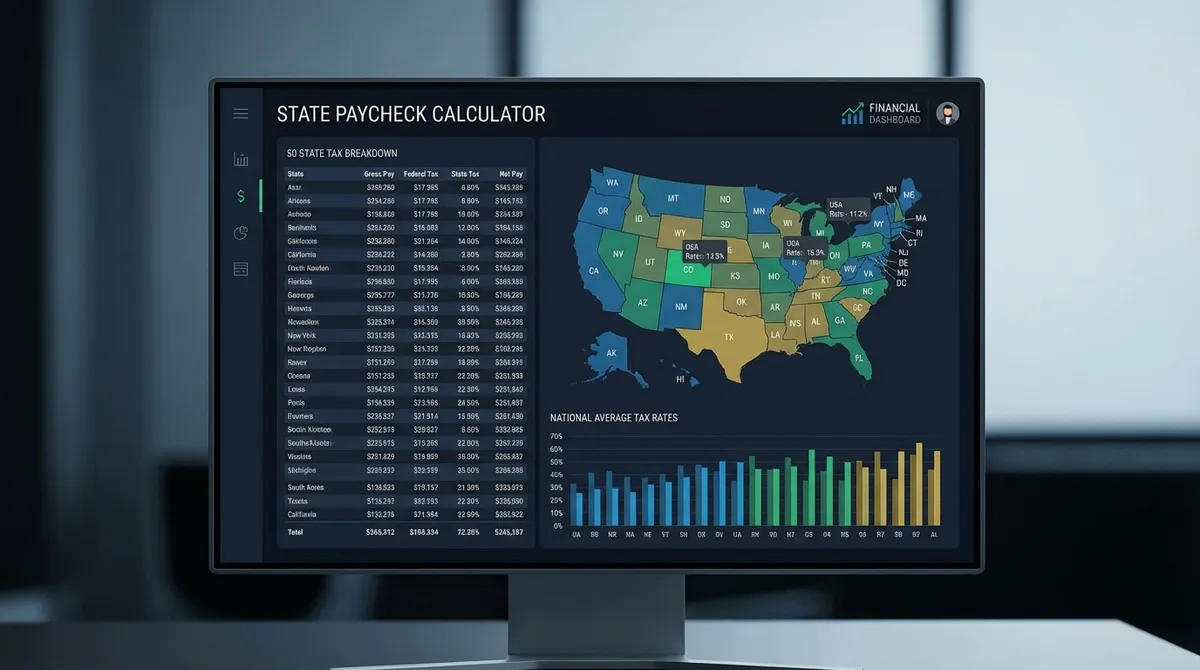

Why Does My Paycheck Vary by State?

While Federal Income Tax and FICA taxes (Social Security and Medicare) are consistent regardless of where you live, State Income Tax is the wild card. The United States operates under a federalist system where states have the autonomy to levy their own taxes on income, sales, and property.

Some states take a significant chunk of your earnings to fund public services like schools, roads, and healthcare, while others take nothing at all. This means earning $100,000 in Austin, Texas, results in a very different paycheck than earning $100,000 in San Francisco, California—potentially a difference of $5,000 to $8,000 per year! This discrepancy makes "geo-arbitrage"—earning a high salary while living in a low-tax state—a popular financial strategy.

The Three Types of State Tax Systems

As you compare states using our calculator, you'll notice three main tax structures that define the US tax landscape:

- Progressive Tax (Most Common): Like the federal system, higher earners pay a higher percentage. States like California, New York, Hawaii, and Minnesota use this model. In these states, your first dollars are taxed at a low rate, while your last dollars (marginal income) are taxed at a much higher rate. This structure is designed to be fairer but can penalize high income earners.

- Flat Tax: Everyone pays the same percentage rate, regardless of income. States like Illinois (4.95%), Indiana (3.05%), Pennsylvania (3.07%), and North Carolina (4.5%) use this simple approach. While simpler to understand, flat taxes can sometimes be regressive if they don't have generous standard deductions.

- No Income Tax: The holy grail for some high earners. These states levy 0% on wages, relying instead on sales taxes, property taxes, or tourism revenue.

- The 9 States: Alaska, Florida, Nevada, New Hampshire (investments only), South Dakota, Tennessee, Texas, Washington, and Wyoming.

- Note: Washington does have a capital gains tax on high earners, but wages remain untaxed.

💡 Pro Tip: Cost of Living Matters

Don't choose a state solely based on tax rates! A state with 0% income tax might have sky-high property taxes (like Texas) or high sales taxes (like Tennessee). Similarly, Hawaii has high income taxes and an incredibly high cost of living. Always consider the total "tax burden" and use a Cost of Living Calculator in conjunction with this paycheck tool to get the full picture.

Understanding Your Pay Stub Deductions (2025)

When you look at your results above, here is exactly what is being deducted and where that money goes:

- Federal Income Tax: Calculated based on the 2025 tax brackets. This is a progressive tax that funds national defense, veteran benefits, law enforcement, education, and interest on the national debt. Your employer estimates this based on your W-4 form.

- Social Security (6.2%): A mandatory FICA tax. In 2025, this applies to the first roughly $176,100 of your earnings (the wage base limit). Income above that cap is not taxed for Social Security. This money funds the retirement & disability benefits for current retirees.

- Medicare (1.45%): Another mandatory FICA tax that funds healthcare for seniors and those with disabilities. Unlike Social Security, there is no income cap—all wages are taxed.

- Additional Medicare Tax: High earners (single filers >$200k, married joint >$250k) pay an extra 0.9%, bringing the total to 2.35%.

- State Income Tax: The variable portion calculated by this tool based on your specific state's rules, standard deductions, and personal exemptions.

- Local/City Taxes (Not always shown): Some cities (NYC, Philadelphia, St. Louis) levy their own income tax. Our calculator focuses on state-level data, so be sure to check your local municipality.

How Marginal Tax Brackets Work

A common misconception is that moving into a higher tax bracket means all your money is taxed at that higher rate. This is false. The US tax system is marginal.

For example, if the 22% federal bracket starts at roughly $47,000 (for single filers), earning $47,001 only subjects that single extra dollar to the 22% rate. The first $47,000 is still taxed at the lower 10% and 12% rates. This ensures that earning more money never results in less take-home pay purely due to tax brackets.

Bonus Taxation: Why Your Bonus Check Looks Smaller

If you receive a performance bonus, current-year commission, or severance pay, you might be shocked to see nearly half of it disappear in taxes. This happens because the IRS treats "supplemental wages" differently.

Employers often use the Percentage Method for bonuses, withholding a flat 22% for federal tax (up to $1 million) regardless of your actual bracket. When you add 6.2% Social Security, 1.45% Medicare, and state taxes (e.g., California’s flat 10.23% on bonuses), strict withholding can easily eat up 40-50% of the check.

Good News: This is just withholding. If your actual effective tax rate is lower than the withheld amount, you will get the difference back as a refund when you file your tax return.

Strategies to Increase Your Take-Home Pay

While taxes are mandatory, you can optimize your finances to handle them better and potentially increase your net worth:

- Pre-Tax Contributions: contributing to a 401(k), 403(b), or Traditional IRA reduces your "taxable income." If you are in the 24% federal bracket + 6% state bracket, every $1,000 you contribute significantly lowers your tax bill immediately.

- HSA (Health Savings Account): If you have a high-deductible health plan, HSA contributions are triple-tax-advantaged: tax-deductible in, tax-free growth, and tax-free out for medical expenses. They also lower FICA taxes if contributed via payroll deduction.

- Update Your W-4: If you consistently get a massive tax refund ($3,000+), you are essentially giving the government an interest-free loan throughout the year. Adjust your W-4 withholdings to get more money in each paycheck instead, which you can invest or use to pay down debt.

- Filing Status: Ensure you are filing correctly. "Head of Household" often has more favorable tax brackets and a larger standard deduction than "Single" if you have qualifying dependents.

Paycheck Comparison: High-Tax vs. Low-Tax States

Let's look at a hypothetical scenario for a single filer earning $100,000 in 2025 to see the real impact of geography. *Note: These are estimates for illustration.*

- Florida (No Income Tax):

- Federal: ~$14,260

- FICA: ~$7,650

- State: $0

- Net Pay: ~$78,090

- California (High Progressive Tax):

- Federal: ~$14,260

- FICA: ~$7,650

- State: ~$5,800 (approx. effective rate)

- State Disability (CASDI): ~$1,100

- Net Pay: ~$71,190

In this example, the Florida resident takes home nearly $7,000 more per year than their California counterpart for the exact same gross salary. This difference compounds over time if invested.

Useful Tools for Your Paycheck

Managing your paycheck goes beyond just knowing your net pay. Use these tools to optimize your tax situation:

- Hourly to Salary Calculator - Convert your hourly wage to an annual salary.

- Federal Income Tax Calculator - Estimate your federal tax liability.

- Bonus Tax Calculator - Calculate taxes on your bonus checks.

- W-4 Calculator - Optimize your W-4 withholdings.

- Tax Refund Calculator - Estimate your potential tax refund.

External Resources

For more information on tax withholding, visit the IRS Tax Withholding Estimator.

Frequently Asked Questions

Which states have no income tax in 2025?+

For the 2025 tax year, the states with zero state income tax on wages are: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire does not tax earned wages but does tax investment income (interest and dividends), though this is being phased out.

Why does my paycheck look different than this calculator?+

This calculator provides a precise estimate based on statutory tax rates and standard deductions. However, your actual paycheck may differ due to pre-tax deductions (health insurance, dental, vision, 401k), post-tax deductions (Roth 401k, union dues, garnishments), or specific company benefits. Your employer's payroll software may also use a different withholding method for federal taxes.

What is the Social Security wage base for 2025?+

The projected Social Security wage base limit for 2025 is approximately $176,100 (subject to official SSA announcement). This means you only pay the 6.2% Social Security tax on earnings up to this amount; earnings above it are exempt from this specific tax, though Medicare tax continues indefinitely.

Does living in a tax-free state always save money?+

Not always. States need revenue to operate, so if they don't tax income, they often tax other things. For example, Texas has some of the highest property tax rates in the nation, and Tennessee has high sales tax rates. It's important to look at the total "tax burden" (Income + Property + Sales) and the cost of living (Housing, Utilities, Groceries) in that specific area.

How do local taxes affect my paycheck?+

Some cities and counties levy their own income taxes on top of state and federal taxes. Notable examples include New York City, Yonkers, and many municipalities in Ohio (RITA), Pennsylvania, and Maryland. This calculator primarily estimates state and federal taxes; you should check your local municipality's website to see if additional local income taxes apply to you.