Complete Guide: Student Loan Calculator

Understanding your student loan repayment strategy is crucial for financial success after graduation. With over 43 million Americans carrying student loan debt totaling $1.74 trillion, mastering your repayment plan can save you thousands of dollars and years of stress.

1What Makes Student Loans Different

Unlike other types of debt, student loans come with unique features that borrowers must understand to make informed decisions. The federal student loan program offers protections and repayment options not available with private loans or other forms of consumer debt.

Key Distinguishing Features

- •Grace periods: Most federal loans offer 6 months after graduation before payments begin, giving you time to secure employment

- •Deferment and forbearance: Options to temporarily pause payments during financial hardship or continuing education

- •Income-driven repayment plans: Monthly payments based on your income and family size, not just loan balance

- •Loan forgiveness programs: Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness for qualifying careers

- •Subsidized interest: Federal Direct Subsidized Loans don't accrue interest while you're in school half-time or during deferment

2025 Student Loan Landscape

2How Student Loan Interest Works

Understanding how interest accrues on your student loans is essential for minimizing the total amount you'll repay. Interest begins accumulating on most loans from the moment they're disbursed, but the rules differ significantly between federal and private loans.

Daily Simple Interest Formula

Daily Interest = Current Balance × Annual Rate ÷ 365

This amount is added to your loan balance each day, and your monthly interest charge is the sum of daily accruals

During School

Unsubsidized loans: Interest accrues immediately. Subsidized loans: No interest accrues while enrolled at least half-time.

During Grace Period

Unsubsidized: Interest continues accruing. Subsidized: No interest during the 6-month grace period.

During Repayment

Interest accrues on the outstanding balance. Extra payments go directly to principal, reducing future interest.

⚠Critical Insight: Capitalization

When your grace period ends, any unpaid interest capitalizes - meaning it gets added to your principal balance. This increases the amount on which future interest is calculated, costing you more over time. A $5,000 interest balance capitalizing onto a $30,000 loan at 6% means you'll pay an extra $300 in interest in the first year alone.

Example: Real Cost of Waiting

Let's say Jessica has $35,000 in unsubsidized federal loans at 6.5% interest. She graduated in May 2025 and her grace period ends in November 2025. During those 6 months, approximately $1,136 in interest accrues. If Jessica can't pay this interest before it capitalizes, her new principal becomes $36,136. Over a 10-year repayment term, this capitalization costs her an additional $368 in interest.

3Choosing the Right Repayment Strategy

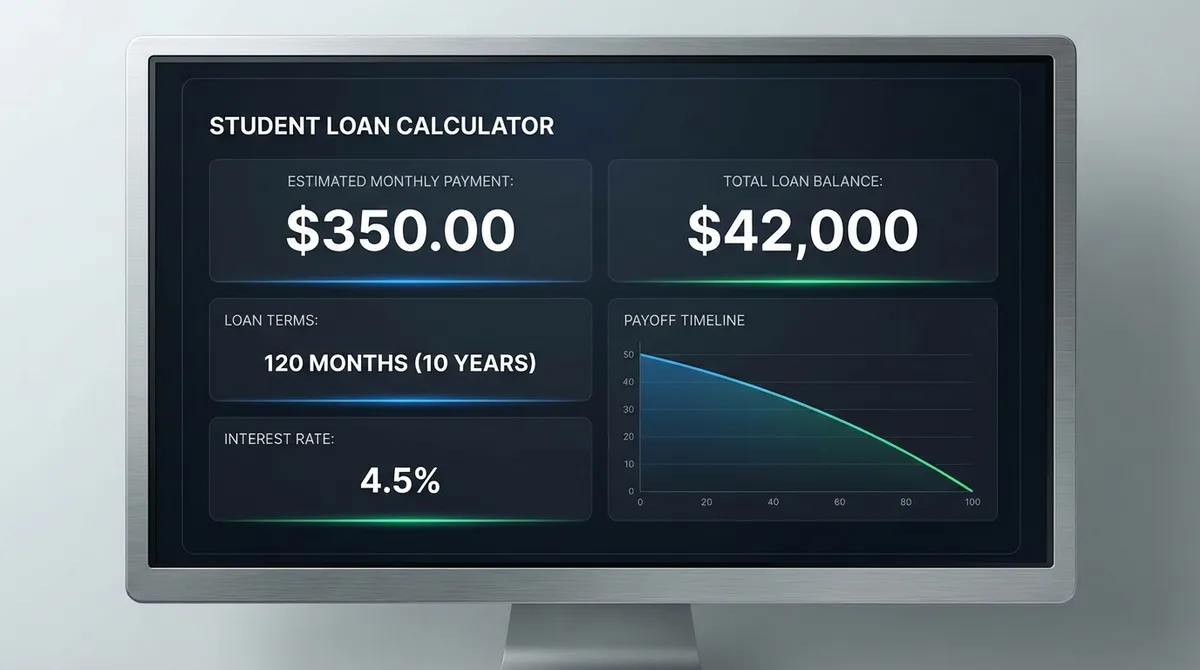

Your repayment plan choice dramatically impacts both your monthly budget and total interest paid. The calculator above models several strategies, each with distinct advantages for different financial situations.

| Plan Type | Best For | Monthly Payment | Total Interest | Payoff Time |

|---|---|---|---|---|

| Standard | Stable income, want to minimize interest | $379 | $10,480 | 10 years |

| Graduated | Expect income to increase over time | $213→$633 | $13,920 | 10 years |

| Extended | Need lowest possible monthly payment | $214 | $29,200 | 25 years |

| Income-Driven | Low income relative to debt | $180-400 | $18,000-45,000* | 20-25 years |

*Higher totals due to forgiveness programs and longer terms. Assumes $35,000 loan at 5.5% interest and $45,000 income.

The Power of Extra Payments

Making extra payments directly reduces your principal balance, which means less interest accrues over time. Even small additional payments can create massive savings. Consider Marcus, who has a $40,000 federal loan at 5.8% interest. His standard payment is $440/month for 10 years, totaling $52,800.

With Extra $100/month

- New payment:$540/month

- Payoff time:7.3 years

- Total interest:$7,480 (vs $12,800)

- Interest saved:$5,320

With Extra $200/month

- New payment:$640/month

- Payoff time:5.6 years

- Total interest:$5,820 (vs $12,800)

- Interest saved:$6,980

4Federal vs. Private Student Loans: Critical Differences

Understanding whether your loans are federal or private is crucial, as they offer vastly different protections, repayment options, and interest rates. Most borrowers have a mix of both, but federal loans should always be prioritized due to their superior benefits.

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest Rate | Fixed, set by Congress (5.50%-8.05% for 2025) | Variable or fixed, based on credit (4%-15%+) |

| Income-Driven Repayment | Multiple options available (SAVE, PAYE, REPAYE) | Generally not available |

| Loan Forgiveness | PSLF, Teacher Forgiveness, IDR Forgiveness | Extremely rare, limited programs |

| Deferment/Forbearance | Multiple options, up to 3 years cumulative | Limited, varies by lender, may accrue interest |

| Subsidized Interest | Available for Direct Subsidized Loans | Not available |

| Discharge Options | Disability discharge, death discharge, closed school | Very limited, varies by lender |

⚠ Important Warning: Private Loan Refinancing

While refinancing federal loans with a private lender might lower your interest rate, you'll permanently lose federal protections including income-driven repayment, loan forgiveness eligibility, and generous deferment options. Only refinance federal loans if you have stable income, strong emergency savings, and don't plan to use federal benefits.

Rule of thumb: Keep federal loans federal unless your income is secure and you have sufficient savings to weather financial storms.

Loan Consolidation Considerations

Federal Direct Consolidation combines multiple federal loans into one, simplifying payments but potentially extending your term. Key considerations:

Pros

- • Single monthly payment

- • Access to additional repayment plans

- • Fixed interest rate (weighted average)

- • May restore eligibility for deferment

Cons

- • May lose certain borrower benefits

- • Extends repayment period (more interest)

- • Weighted average interest rate rounds up

- • Outstanding interest capitalizes

5Common Student Loan Mistakes That Cost Thousands

After analyzing thousands of student loan repayment scenarios, we've identified the most expensive mistakes borrowers make. Avoiding these pitfalls can save you significant money and stress.

1Missing the Grace Period Opportunity

Many graduates treat their 6-month grace period as a complete payment pause. While no payments are required, making interest-only payments during this period prevents thousands in capitalization costs.

Real cost: On a $35,000 loan at 6.8%, not paying the $1,190 in interest during grace period means paying interest on that $1,190 for the entire loan term, costing an extra $446 over 10 years.

2Choosing Extended Repayment Blindly

The lower monthly payment of extended plans seems attractive, but borrowers rarely calculate the total cost. Extended repayment can more than double your total interest paid.

3Not Understanding Tax Implications

Student loan interest is tax-deductible up to $2,500 annually (in 2025), but many borrowers don't claim this deduction. Additionally, forgiven loan amounts under income-driven plans are taxable income unless specifically exempted (like PSLF).

4Consolidation Without Analysis

Consolidating federal loans resets the clock on progress toward forgiveness programs and may increase your interest rate slightly due to rounding. Only consolidate if you need the simplified payment or access to different repayment plans.

5Refinancing Federal Loans Too Early

Refinancing to a lower interest rate seems smart, but doing so before establishing stable income or building emergency savings is risky. Once you refinance federal loans privately, you cannot return to federal protections.

6Loan Forgiveness Programs: What You Need to Know

Federal student loans offer several forgiveness programs that can significantly reduce or eliminate your debt, but they require careful planning and strict adherence to program rules.

Public Service Loan Forgiveness (PSLF)

- • Requires 120 qualifying monthly payments (10 years)

- • Must work full-time for qualifying employer

- • Federal, state, local government; 501(c)(3) nonprofits

- • Must be on income-driven repayment plan

- • Remaining balance is tax-free

Best for: Teachers, nurses, government employees, nonprofit workers with high debt-to-income ratios.

Teacher Loan Forgiveness

- • Up to $17,500 for 5 years of service

- • Must teach in low-income school/agency

- • Highly qualified teacher requirement

- • Direct Subsidized & Unsubsidized Loans only

- • Cannot double-count with PSLF

Best for: Full-time teachers in qualifying schools, especially math, science, and special education.

Income-Driven Repayment (IDR) Forgiveness

SAVE Plan

PAYE Plan

IBR Plan

ICR Plan

Warning: Forgiven amounts under IDR plans (except PSLF) are taxable as income in most states. Plan for potential tax bills on forgiven balances.

7Useful Student Loan Tools

Plan your repayment strategy with these additional resources:

- Student Loan Payoff Calculator - See how extra payments help.

- Loan Repayment Calculator - General loan amortization.

- Interest Calculator - Calculate interest costs.

- College Cost Calculator - Estimate total education costs.

- Budget Calculator - Manage your finances during repayment.

Visit StudentAid.gov for official federal loan information.

8Your Action Plan for Student Loan Success

Now that you understand how student loans work, here's your step-by-step action plan to minimize costs and maximize financial freedom:

Immediate Actions (Within 30 Days)

- 1.Identify all your loans: Log into studentaid.gov and check with private lenders to create a complete inventory

- 2.Calculate grace period end dates: Mark your calendar for when payments begin for each loan

- 3.Consider interest-only payments: During grace periods, prevent interest capitalization

- 4.Set up automatic payments: Many lenders offer 0.25% interest rate reduction for autopay

Short-Term Strategy (1-12 Months)

- 1.Choose the right repayment plan: Use our calculator to compare total costs, not just monthly payments

- 2.Build emergency savings: Save 3-6 months of expenses before making extra loan payments

- 3.Explore employer benefits: Many companies now offer student loan repayment assistance

- 4.Consider consolidation carefully: Only if it provides access to needed repayment plans

Long-Term Optimization (1-10 Years)

- 1.Maximize extra payments strategically: Target highest-interest loans first while maintaining minimums on all loans

- 2.Track progress toward forgiveness: If pursuing PSLF or IDR forgiveness, annually verify qualifying payments

- 3.Reassess annually: Income changes may qualify you for different repayment plans or refinancing opportunities

- 4.Plan for tax implications: Save money for potential taxes on forgiven debt (except PSLF)

⚠ When to Seek Professional Help

- • You have complex tax situations involving student loan interest deductions

- • Considering bankruptcy and student loan discharge (very difficult)

- • Disability discharge applications

- • Disputes with loan servicers about payment counts for forgiveness

- • You're overwhelmed and need help creating a comprehensive repayment strategy

Key Takeaways

Student loan repayment is a marathon, not a sprint. Understanding your loans, choosing the right repayment strategy, and making informed decisions about consolidation, refinancing, and forgiveness programs can save you tens of thousands of dollars.

The single most powerful action: Making even small extra payments toward principal early in your loan term creates exponential savings through reduced interest compounding.

- ✓Know your loan types and their unique benefits

- ✓Calculate total loan costs, not just monthly payments

- ✓Consider federal protections before refinancing

- ✓Track progress toward forgiveness if applicable

- ✓Reassess your strategy annually as circumstances change

Ready to Take Control?

Use our student loan calculator above to model your specific situation, compare repayment strategies, and see the impact of extra payments. Your future self will thank you for the hours spent understanding and optimizing your student loan repayment plan today.

About the Author

Marko Šinko, Finance Expert and CPA, has spent over 15 years helping individuals navigate complex financial decisions, with particular expertise in student loan strategies and debt optimization.

Credentials: Certified Public Accountant (CPA), Member of AICPA, Regular contributor to financial literacy programs

Connect: Full bio and contact

Disclaimer: This article is for educational purposes and doesn't constitute financial advice. Consult with a qualified financial advisor for personalized guidance.