Complete Guide to Student Loan Payoff (2025)

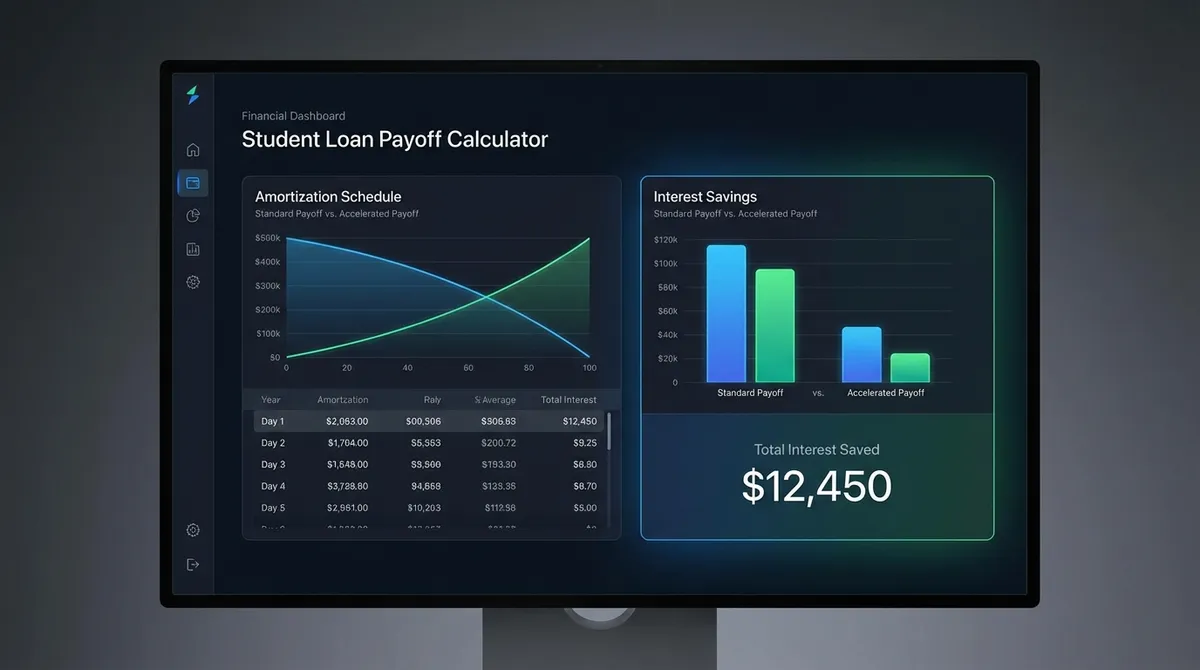

Student loans can feel like a mountain that never shrinks. You make payments every month, but the balance barely budges. The secret to conquering this debt isn't just "paying more"—it's paying strategically. By understanding how interest accrues daily and leveraging the power of extra principal payments, you can shave years off your repayment timeline and save thousands in interest. This guide—and our calculator above—will show you exactly how to do it.

The "Daily Interest" Trap

Student loans typically accrue interest daily. This means every day you hold a balance, it costs you money. Paying early or extra cuts this cycle immediately.

100% Principal Impact

Once you cover the month's accrued interest, 100% of any extra payment goes straight to principal. This is where the magic happens.

The Math Behind Early Payoff

Most borrowers assume that if they have a 10-year loan, it "has" to take 10 years to pay off. That is false. The term is just the maximum time allowed. The formula for student loan interest is typically:

Because interest is calculated on the Outstanding Principal, every time you lower that principal balance with an extra payment, you permanently reduce the daily interest charge for every single day that follows. It is a snowball effect in reverse—the more you pay now, the less interest accumulates later.

Avalanche vs. Snowball: Which is Better?

The Avalanche Method (Mathematically Optimal)

Focus all extra payments on the loan with the highest interest rate first, regardless of the balance.

Saves the most money total.

The Snowball Method (Psychologically Easier)

Focus all extra payments on the loan with the smallest balance first to knock it out quickly.

Builds momentum through "quick wins".

Important for 2025 Borrowers

With federal student loan interest rates for new loans hitting highs (up to ~8% for PLUS loans), prioritizing payoff is more critical than ever.

- Tax Deduction: You can still deduct up to $2,500 in student loan interest on your taxes, subject to income limits.

- IDR Plans: If you are on the SAVE plan or other Income-Driven Repayment plans, extra payments still help, but ensure they are applied to principal and not "paid ahead" for future months.

Frequently Asked Questions

Does paying extra automatically reduce my principal?

Not always! Some loan servicers will apply extra payments to "future months" (advancing your due date) instead of reducing the principal immediately. This is often called "paid ahead status." While it gives you a buffer if you miss a payment later, it does not save you as much money on interest. You must explicitly instruct your servicer to apply extra funds to the principal balance. Most online portals have a checkbox for this option, typically labeled "Do not advance due date," or you can call them to set it as the default preference for your account.

Is it better to pay off student loans or invest?

This is the classic "guaranteed return vs. potential return" debate. It depends heavily on your interest rate versus expected investment returns.

- High Interest (>6%): If your loan rate is above 6%, paying it off offers a guaranteed 6%+ "return" which is risk-free and tax-free (effectively higher). This is often the best financial move.

- Moderate Interest (4-6%): This is the gray zone. You might split your extra cash between investing and paying down debt.

- Low Interest (<4%): Investing in the market (which historically averages ~7-10% inflation-adjusted) might be mathematically superior. Additionally, inflation erodes the "real" value of your debt over time.

However, many people prefer the psychological freedom and reduced stress of being debt-free regardless of the math.

Can I pay off my student loans with a credit card to get points?

Generally, no. Most federal and private loan servicers do not accept credit cards directly because of the merchant processing fees (1.5% - 3%). Third-party services like Plastiq exist to facilitate this, but they usually charge a fee (e.g., 2.9%) that effectively wipes out the value of any rewards points or cash back you would earn. Unless you are trying to hit a massive "sign-up bonus" on a new card, using a credit card is rarely worth the cost.

How does a lump sum payment affect my monthly bill?

Making a large lump sum payment reduces your outstanding balance and total future interest, but it usually does not lower your required monthly minimum payment. Your loan term simply becomes shorter. If you want a lower monthly bill instead of a shorter term, you must ask for the loan to be "recast" (or re-amortized). Recasting keeps your original payoff date but lowers the monthly due amount based on the new, smaller principal. Note that federal loans handle this differently than private lenders; always call to confirm.

What happens if I overpay my final payment?

It is common to slightly overpay the final amount due to daily interest accrual differences. If you pay more than the remaining payoff amount, the servicer will refund the difference. This usually takes 30-60 days and will be sent via check to your address on file or as a direct deposit to your linked bank account.

Should I refinance my student loans?

Refinancing involves taking out a new loan with a private lender to pay off your existing loans.

Pros:

- Potentially lower interest rate.

- Simplify multiple loans into one payment.

- Release a co-signer.

Cons:

- Loss of Federal Benefits: If you refinance federal loans, you lose access to Income-Driven Repayment (IDR) plans, Public Service Loan Forgiveness (PSLF), and federal forbearance options.

- Fixed vs. Variable rates considerations.

Refinancing is generally best for private loans or for high-income earners with stable jobs who don't need federal protections.

Deep Dive: Understanding Student Loan Payoff Strategies

1. The "Standard Repayment" Baseline

By default, federal student loans are placed on a 10-year Standard Repayment Plan. This plan calculates a fixed monthly amount that ensures the loan is paid off in exactly 120 payments. While this minimizes interest compared to longer plans, strictly following it means you are missing out on the massive savings of early repayment.

2. The Impact of Capitalized Interest

Capitalization occurs when unpaid interest is added to your principal balance. This is dangerous because future interest is then calculated on this larger amount (interest on interest). Capitalization typically happens:

- After a period of deferment or forbearance ends.

- When leaving an Income-Driven Repayment plan.

- When you consolidate loans.

Pro Tip: If possible, pay off the accrued interest before it capitalizes. This prevents your principal from ballooning and saves you money over the life of the loan.

3. Income-Driven Repayment (IDR) & Forgiveness

If you are pursuing Public Service Loan Forgiveness (PSLF) or are on an IDR plan hoping for forgiveness after 20-25 years, extra payments might be a waste of money.

- For PSLF: You want to pay the least amount possible for 120 payments until the remainder is forgiven tax-free.

- For IDR Forgiveness: Paying extra reduces the amount that would eventually be forgiven. However, you must weigh this against the potential "tax bomb" (if the forgiven amount is treated as taxable income, though this is currently suspended federally through 2025).

4. Bi-Weekly Payments Hack

Instead of paying monthly, you can pay half your monthly bill every two weeks.

- There are 52 weeks in a year, which means 26 bi-weekly periods.

- 26 half-payments = 13 full payments per year.

- This "trick" sneaks in one extra full payment every year without feeling like a burden, shortening a 10-year loan to roughly 8 years and 9 months.

5. Helpful Resources

Use these calculators to refine your payoff plan:

- Student Loan Calculator - Estimate payments and interest.

- Debt Payoff Calculator - Plan for all your debts.

- Extra Payment Calculator - See the impact of paying more.

- Savings Calculator - Plan for your future goals.

- Amortization Calculator - Visualize your loan schedule.

Check out StudentAid.gov Repayment Plans for official options.

Ready to be debt-free faster?

Even an extra $50 a month makes a difference.