What Is Take-Home Pay and Why It Matters in 2025?

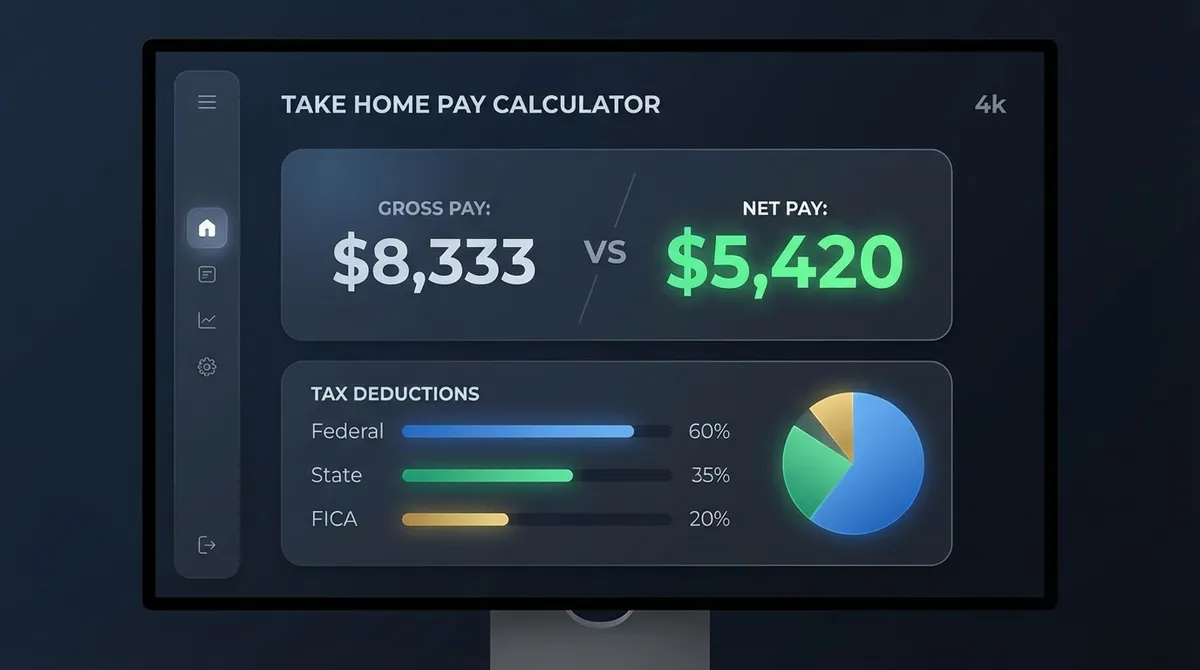

Take-home pay—often called net pay—is the money that actually lands in your bank account after Uncle Sam and other deductions take their cut. It's the only number that really matters for paying rent, buying groceries, or saving for that dream vacation.

In 2025, the gap between your "on paper" salary and your real income can be shocking. Dealing with federal brackets (10% to 37%), state taxes, and FICA (7.65%), a $75,000 salary might practically look more like $55,000. This calculator cuts through the complexity to show you exactly where every dollar goes, visualizing your tax burden with clear charts so you can plan with confidence.

Reality Check: The average American worker sees about 25-30% of their paycheck vanish before payday. Understanding these deductions is the first step to optimizing them—whether that's through 401(k) contributions or better tax planning.

The Logic Behind Your Paycheck: Where Does the Money Go?

Your paycheck isn't just a random number. It's calculated using a precise waterfall of deductions. Here is how the math works for 2025:

1. Federal Income Tax (The Big Hit)

The U.S. uses a progressive tax system. This means you don't pay one flat rate on all your income. Instead, your money fills up "buckets" (tax brackets). The first bucket is cheap (10%), but the last bucket is expensive (up to 37%).

2025 Tax Brackets (Single Filers):

2. FICA Taxes (The Flat Fees)

Unlike income tax, FICA taxes are flat rates that nearly everyone pays from the first dollar earned:

- •Social Security (6.2%): Capped at $176,100 of income for 2025.

- •Medicare (1.45%): No cap. High earners (over $200k) pay an extra 0.9%.

3. State Taxes (Location, Location, Location)

Your zip code matters. Live in Texas or Florida? You pay 0% state tax. Live in California or New York? You could pay an extra 5-13%. Our calculator lets you input your specific state rate to get a precise estimate.

Case Study: Jennifer's $65,000 Salary

Let's look at Jennifer, a marketing manager in Colorado earning $65,000. She's single and contributes 6% to her 401(k).

Jennifer's Inputs

- • Gross Salary: $65,000

- • 401(k): $3,900 (Pre-tax)

- • State: Colorado (~4.4%)

The Results

- • Federal Tax: ~$6,261

- • FICA: $4,973

- • State Tax: ~$2,684

- • Take-Home Pay: $47,182

Despite a $65k salary, Jennifer actually lives on ~$47k. However, because she used pre-tax 401(k) contributions, she lowered her federal tax bill by nearly $900.

Pre-Tax vs. Post-Tax: Why It Matters

Pre-Tax Deductions ("The Good Guys")

These come out of your check before taxes are calculated. They lower your taxable income, saving you money instantly.

- Traditional 401(k) / 403(b)

- Health Insurance Premiums

- HSA / FSA Contributions

- Commuter Benefits

Post-Tax Deductions

These come out after taxes. They reduce your take-home pay dollar-for-dollar and offer no immediate tax benefit.

- Roth 401(k) / Roth IRA

- Wage Garnishments

- Union Dues (usually)

- Life Insurance (Supplemental)

How to Read Your Pay Stub

Pay stubs can be confusing codes of acronyms. Here is a decoder for the most common terms you'll see in 2025:

Federal Withholding. This is your prepayment of federal income tax. If this number is too high, you get a refund. If too low, you owe money.

Old-Age, Survivors, and Disability Insurance (Social Security). The 6.2% flat tax that funds retirement benefits.

Medicare. The 1.45% tax that funds healthcare for seniors.

Year-to-Date. The total amount earned or deducted since January 1st. Always check this in December to compare against your W-2.

How to Keep More of Your Money

Maximize Pre-Tax Deductions

The best way to lower your taxes is to reduce your taxable income. Contributing to a 401(k) or HSA (Health Savings Account) shields that money from the IRS today. It's not just savings; it's a tax hack.

Fix Your W-4

Getting a huge refund isn't a victory—it means you gave the government an interest-free loan. Use our calculator to match your withholdings to your actual liability so you get more money in every paycheck throughout the year.

Common Questions

Will my bonus be taxed higher?

It feels like it, but not really. Employers often withhold a flat 22% from bonuses, which might be higher than your usual rate. However, at tax time, bonuses are just regular income. If too much was taken out, you get it back as a refund.

What is the "Additional Medicare Tax"?

This applies to high earners. If you earn over $200,000 (single) or $250,000 (married joint) in 2025, you pay an extra 0.9% on every dollar above that threshold. Our calculator automatically checks for this.

Does this calculator include local taxes?

This tool handles Federal, State, and FICA. However, some cities (like NYC or Philadelphia) have their own local income taxes. You should account for these as part of your "State Tax" estimate if applicable.

Does this work for self-employed people?

No. Self-employed individuals pay the full 15.3% SE tax (both employer and employee portions of FICA). You should use our specific Self-Employment Tax Calculator for accuracy, as your tax situation is different.

Can I deduct student loan interest from take-home pay?

Student loan interest is an "above-the-line" deduction on your tax return, but it does not directly come out of your paycheck like a 401(k) does. It may increase your refund at the end of the year, but it wont change your immediate take-home pay.

The "Hidden" Deductions: Benefits & Perks

While taxes take the biggest chunk, voluntary deductions for benefits can significantly impact your take-home pay. However, these are often "good" costs that save you money elsewhere.

Medical & Dental Premiums

The average employee pays ~$115/month for single coverage and ~$500/month for family coverage. This is deducted pre-tax, meaning you don't pay income tax on money spent on premiums.

FSA & HSA Contributions

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) allow you to set aside pre-tax money for medical costs. This lowers your take-home pay today but pays for doctor visits with tax-free dollars.

Commuter Benefits

You can set aside up to ~$315/month (2025 proj) pre-tax for parking or transit. If you take the train to work, this deduction effectively gives you a ~30% discount on your fare.

Group Life & Disability

Often pennies on the dollar compared to private insurance. These are typically post-tax deductions but offer critical financial protection.

The "Invisible Tax": Inflation's Impact in 2025

Even if your take-home pay number stays the same, what you can buy with it changes. If inflation is running at 3%, a $5,000 monthly paycheck effectively becomes $4,850 in purchasing power compared to last year.

Always neogtiate raises based on real wage growth. If you didn't get a raise of at least 3-4% this year, your take-home pay effectively went down in value, even if the number on the check is the same.

Hourly vs. Salary: Who Takes Home More?

A $60,000 salary and a $28.85/hour wage equal the same gross annual income (assuming 40 hours/week). However, the take-home pay dynamics can differ wildly based on overtime and consistency.

| Factor | Salaried Employee | Hourly Employee |

|---|---|---|

| Overtime | Usually $0 (Exempt). You work 50 hours, you get paid for 40. | 1.5x pay. Working 5 hours OT/week adds ~$11k/year! |

| Consistency | Predictable. Great for budgeting rent/mortgage. | Variable. If hours overlap with holidays or shifts get cut, pay drops. |

| Tax Withholding | Consistent. Refunds are easier to predict. | Fluctuates. High OT weeks might trigger higher withholding rates temporarily. |

Don't Forget State Tax Refunds

Many people focus solely on their federal refund, but your state withholding can also generate a nice surprise check. However, be aware that unlike federal refunds, state tax refunds are often taxable on your next federal return if you itemized your deductions. It is a circular system, but for most people taking the standard deduction, a state refund is just tax-free extra cash.

Author: Jurica Šinko, CPA, MBA

Last Updated: December 11, 2025

Category: Tax & Payroll

Disclaimer: This calculator provides estimates for educational purposes only. Tax laws are complex and subject to change. Always consult a certified tax professional for your specific situation.