Understanding 2025 Federal Tax Brackets: A Complete Guide

The U.S. federal income tax system is progressive, which is often misunderstood. Many Americans fear that earning more money will push them into a higher tax bracket and actually reduce their take-home pay. This is a myth. In a progressive tax system, higher rates only apply to the income that falls within that specific bracket, not your entire salary.

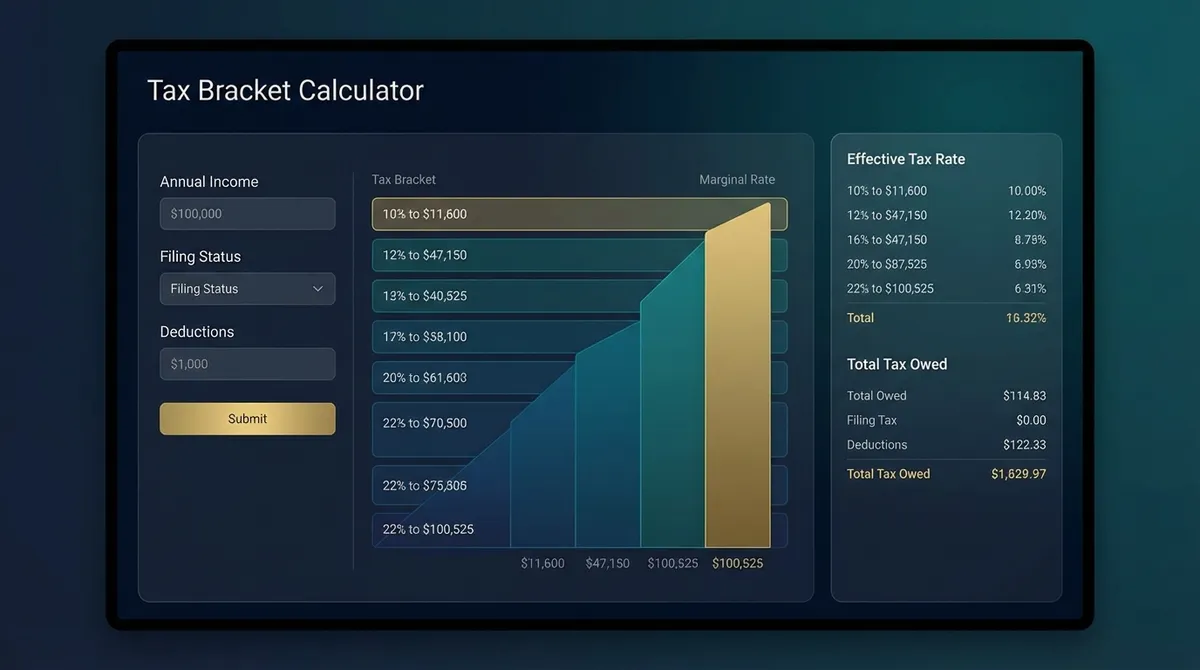

For the 2025 tax year (taxes filed in early 2026), the IRS has adjusted tax brackets and standard deductions for inflation to prevent "bracket creep." Our calculator above uses these official numbers to help you estimate your tax liability and plan your finances effectively.

How Federal Tax Brackets Actually Work

Think of your income as pouring water into a series of buckets. The first bucket fills up tax-free (the standard deduction). The next bucket is taxed at 10%. Once that's full, the overflow goes into the 12% bucket, and so on.

Example: Single Filer Earning $60,000 (2025)

*Notice that even though this earner is in the "22% bracket" (marginal rate), their effective tax rate is much lower (about 8.6%) because much of their income is taxed at 0%, 10%, or 12%.

Official 2025 Tax Brackets & Rates

Here are the official IRS tax brackets for 2025. These apply to income earned from January 1, 2025, to December 31, 2025.

Single Filers

- 10%: $0 to $11,925

- 12%: $11,925 to $48,475

- 22%: $48,475 to $103,350

- 24%: $103,350 to $197,300

- 32%: $197,300 to $250,525

- 35%: $250,525 to $626,350

- 37%: $626,350 or more

Married Filing Jointly

- 10%: $0 to $23,850

- 12%: $23,850 to $96,950

- 22%: $96,950 to $206,700

- 24%: $206,700 to $394,600

- 32%: $394,600 to $501,050

- 35%: $501,050 to $751,600

- 37%: $751,600 or more

Strategic Tax Planning Tips for 2025

1. Maximize "Above-the-Line" Deductions

Contributing to a 401(k) or traditional IRA lowers your taxable income directly. If you are on the edge of a higher bracket, this can be especially powerful.

2. Consider "Bunching" Deductions

With the standard deduction so high ($15,000 for singles, $30,000 for couples), it's hard to itemize. "Bunching" means grouping several years of charitable donations or medical expenses into a single year to exceed the standard deduction threshold.

3. Harvest Capital Losses

If you have investments that have lost value, selling them can offset capital gains and up to $3,000 of ordinary income, potentially lowering your overall tax bill.

Tax Brackets in Context: Are Taxes High?

It might feel like taxes are high, but historically, 2025 rates are relatively low.

- 1944-45:The top marginal tax rate peaked at 94% on income over $200,000 (equivalent to ~$3.5 million today) during WWII.

- 1980:Under the Reagan era, the top rate started at 70% before being slashed to 28% by 1988.

- 2025:The top rate sits at 37%, and it only kicks in for income over $600,000+.

How Filing Status Changes Your Bracket

Your filing status effectively determines the "width" of your tax buckets. A wider bucket means you can earn more money before spilling over into a higher tax rate.

Single vs. Married Jointly

For the most part, the Married Jointly brackets are exactly double the Single brackets. This prevents the "Marriage Penalty" for most couples.

Example: The 22% bracket ends at ~$103k for Singles and ~$206k for Married couples. If two people each earning $100k get married, their combined tax generally stays the same.

Head of Household (HOH)

This is the "Goldilocks" status. It offers wider brackets than Single but narrower than Married.

Benefit: To qualify, you must be unmarried and pay more than half the cost of maintaining a home for a qualifying child or dependent. It is significantly better than filing Single.

Common Misconceptions

The "Bonus Tax" Myth

People often think bonuses are taxed at a higher rate. They are often withheld at a higher flat rate (22%), but when you file your taxes, the bonus is just treated as regular income. If you overpaid via withholding, you'll get it back as a refund.

Marginal vs. Effective Rate

Never confuse these. Your marginal rate is just the rate on your last dollar earned. Your effective rate (total tax / total income) is the real percentage of your income that goes to the IRS, and it is almost always significantly lower.

Does the "Marriage Penalty" Still Exist?

Historically, married couples often paid more tax than if they had remained single. Since the Tax Cuts and Jobs Act (TCJA), the marriage penalty has been largely eliminated for most brackets—the married thresholds are exactly double the single ones.

Where it still hurts (2025):

- The 37% Bracket: It does NOT double. Single filers hit 37% at ~$626k, while married couples hit it at ~$751k (not $1.25M). Two high earners marrying can suddenly find themselves in the top bracket much sooner.

- SALT Cap: The State and Local Tax deduction is capped at $10,000 per Return, NOT per person. Two singles can deduct $10,000 each ($20k total). A married couple is limited to just $10,000 total.

Frequently Asked Questions

If I move up a bracket, do I make less money?

No. NEVER. Earning $1 more will never result in more than $1 of tax (the highest rate is 37%). You will always take home more money when you get a raise, regardless of brackets.

How are capital gains taxed in these brackets?

Capital gains (money made from selling stocks/assets held >1 year) have their own separate brackets: 0%, 15%, and 20%. These are much lower than ordinary income tax brackets, which is a major advantage for investors.

What is the "Standard Deduction" bucket?

Think of this as the "0% Benefit Bracket." For 2025, the first $15,000 (Single) or $30,000 (Married) you earn is effectively taxed at 0%. This applies to everyone, regardless of how much you earn.

Does my bracket affect my state taxes?

Federal and state brackets are completely separate. You could be in the 32% Federal bracket but live in a 0% tax state (like Texas). Conversely, you could be in a low Federal bracket but pay high state taxes in California.

The Silent Helper: How Inflation Adjustment Works

You might hear the term "Bracket Creep." This happens when inflation raises your salary, pushing you into a higher tax bracket, but your purchasing power stays the same. To fight this, the IRS adjusts the bracket thresholds every year based on the Chained CPI (Consumer Price Index).

If Inflation is High...

The tax brackets "widen" significantly. This means you can earn much more money before hitting the next tax rate. In 2023-2024, brackets widened by ~7%, which was a massive tax cut for people whose salaries didn't grow that fast.

If Deflation Occurs...

It is rare, but if prices drop, brackets could theoretically shrink or stay flat. However, the tax code is generally designed to only adjust upwards, protecting taxpayers from paying more real dollars to the government over time.

How to Confirm Your Tax Bracket

While calculators are great estimates, the only way to know your exact bracket is to look at your tax return structure:

- Find Your Taxable Income: Look at Line 15 on your Form 1040. This is your AGI minus deductions.

- Compare to the Tables: Take that specific number and see where it falls in the IRS tables for your filing status.

- Check Your Effective Rate: Divide Line 24 (Total Tax) by Line 11 (AGI). This percentage is the "real" chunk of your income the government keeps, which is usually much lower than your bracket percentage.