Tax Liability Calculator 2025 Guide

Understanding Your 2025 Tax Liability

Your "tax liability" is the total amount of tax you serve to the government based on your annual earnings. It is the final bill after all calculations, separate from what was withheld from your paycheck. In 2025, inflation adjustments have shifted tax brackets and increased the standard deduction, meaning your money might go further than in previous years—if you understand how the system works.

Many taxpayers confusing "tax refund" with "lower taxes." A large refund simply means you overpaid the government throughout the year (an interest-free loan). A low tax liability means you legally minimized what you owe using deductions, credits, and smart planning. This guide breaks down exactly how to calculate and optimize your 2025 tax burden.

Key Update for 2025: The IRS has raised federal tax bracket thresholds and the standard deduction (approx. $15,000 for singles, $30,000 for married joint filers) to account for inflation. This "bracket creep" prevention means you can earn more money before hitting higher tax rates.

The 4-Step Tax Calculation Formula

Calculating your tax liability isn't just applying a percentage to your salary. It follows a specific "waterfall" logic:

All money earned: Wages (W-2), Interest, Dividends, Business Income, etc.

Gross Income minus "Above-the-Line" deductions like 401(k) contributions and student loan interest.

AGI minus the greater of the Standard Deduction or Itemized Deductions (SALT, Charity, Mortgage Interest).

Apply tax brackets to Taxable Income, then subtract any Tax Credits (Child Tax Credit, Solar, etc.) dollar-for-dollar.

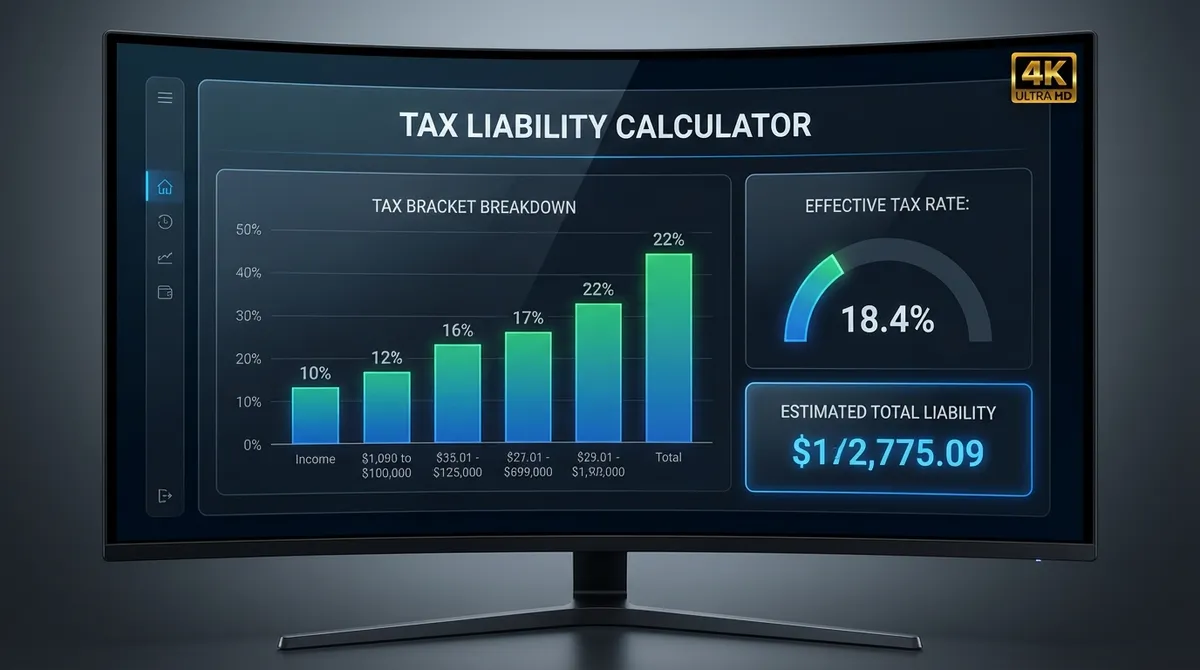

2025 Federal Tax Brackets (Projected)

The US uses a progressive tax system. Being in the "22% bracket" doesn't mean you pay 22% on everything. You pay 10% on the first chunk, 12% on the next, and 22% only on the income above the threshold.

| Rate | Single Filers | Married Jointly |

|---|---|---|

| 10% | $0 to ~$11,925 | $0 to ~$23,850 |

| 12% | $11,926 to ~$48,475 | $23,851 to ~$96,950 |

| 22% | $48,476 to ~$103,350 | $96,951 to ~$206,700 |

| 24% | $103,351 to ~$197,300 | $206,701 to ~$394,600 |

| 32% | $197,301 to ~$250,525 | $394,601 to ~$501,050 |

*Note: These ranges are simplified projections for 2025 tax planning. Official inflation adjustments are released by the IRS typically in late 2024.

Real World Scenario: Single Filer Earning $75k

Let's look at "Alex," a graphic designer in Texas (no state income tax).

- Gross Salary$75,000

- 401(k) Contribution (Pre-tax)-$5,000

- Adjusted Gross Income (AGI)$70,000

- Standard Deduction (2025)-$15,000

- Taxable Income$55,000

The Tax Calculation:

- • First ~$11,925 @ 10% = $1,192.50

- • Next ~$36,550 @ 12% = $4,386.00

- • Remaining ~$6,525 @ 22% = $1,435.50

- Total Tax: ~$7,014

Even though Alex is in the 22% bracket, her effective tax rate is only 9.35% ($7,014 / $75,000).

The Great Debate: Standard vs. Itemized Deduction

This is the single biggest decision in calculating your liability. You can pick ONE, not both. Thanks to the Tax Cuts and Jobs Act (TCJA), nearly 90% of Americans now take the Standard Deduction because it is so high.

The Standard Deduction

A flat amount subtracted from your income based solely on your filing status. No proof required.

*Projected for 2025

Itemized Deductions

You list specific qualified expenses. Only worth it if the total exceeds your Standard Deduction.

- SALT (State & Local Taxes): Capped at $10,000 total (Property + Income/Sales Tax).

- Mortgage Interest: On first $750k of debt for new homes.

- Charitable Gifts: Cash and goods donated to 501(c)(3) charities.

- Medical Expenses: Only amounts exceeding 7.5% of your AGI.

The "Bunching" Strategy

If your itemized deductions are close to the standard deduction (e.g., $14,000 for a single person), they typically produce $0 in extra benefit.

Strategy: "Bunch" two years of charitable donations into one tax year to exceed the threshold, then take the standard deduction the next year. This maximizes your total tax savings over a two-year period.

Credits vs. Deductions: Reducing Your Bill

Tax Deductions

Lowers your Taxable Income.

If you earn $100k and have a $10k deduction in the 22% bracket:

You save $2,200.

- Standard Deduction

- Mortgage Interest

- Charitable Donations

- Student Loan Interest

Tax Credits

Lowers your Tax Bill directly.

If you owe $10k and have a $2,000 credit:

You pay $8,000. You save $2,000.

- Child Tax Credit (CTC)

- Earned Income Tax Credit (EITC)

- Energy Efficient Home Improvement Credit

State Tax Liability: The Other Half of the Equation

While federal taxes get all the headlines, state taxes can take a significant bite out of your paycheck—up to 13.3% in California! Understanding your state's specific tax structure is crucial for accurate liability planning.

Flat Tax States

States that charge a single percentage regardless of income.

- Pennsylvania (3.07%)

- Illinois (4.95%)

- North Carolina (4.75%)

Progressive Tax States

States with brackets similar to the federal system.

- California (1% - 13.3%)

- New York (4% - 10.9%)

- Hawaii (1.4% - 11%)

No Income Tax States

States that generally rely on sales or property taxes instead.

- Texas, Florida, Nevada

- Tennessee, Washington

- Wyoming, South Dakota

Pro Tip: Even if you live in a no-tax state, you may still owe taxes to another state if you earned income there (e.g., remote work, rental property, or commuting). Always check the "nexus" rules for any state where you generate revenue.

Tax Liability Planning by Life Stage

Young Professionals (20s-30s)

Your biggest asset is time. Aggressive reduction of AGI is key.

- Student Loan Interest: Deduct up to $2,500 even without itemizing.

- Roth vs. Traditional: A Traditional 401(k) lowers liability now; Roth pays taxes now for tax-free growth later.

- Lifetime Learning Credit: Use for grad school or certs to lower tax bills directly.

Growing Families (30s-40s)

Kids are expensive, but they offer massive tax breaks.

- Child Tax Credit: $2,000 per kid cuts liability significantly.

- Dependent Care FSA: Use pre-tax dollars for daycare (up to $5,000).

- 529 Plans: Many states offer tax deductions for college savings contributions.

Peak Earners (40s-50s)

You are likely in your highest tax bracket. Shielding income is priority #1.

- Max Out Accounts: Hit the limits on 401(k), HSA, and IRAs.

- Backdoor Roth: If income prevents direct Roth contributions, use the backdoor method.

- Mortgage Interest: Still a valuable deduction if you carry a large mortgage.

Pre-Retirees (50s-60s)

Catch-up contributions can slash your final tax bills.

- Catch-Up Contributions: Add extra thousands to 401(k)s and IRAs after age 50.

- Health Care Costs: Medical expenses over 7.5% of AGI become deductible—track everything.

- Roth Conversions: Strategic conversion in low-income years to prep for RMDs later.

Year-End Tax Planning Checklist

The best time to lower your tax liability is before December 31st. Once the ball drops on New Year's Eve, most opportunities to reduce your taxable income for that year vanish forever. Use this checklist to finish the year strong.

Max Out Pre-Tax Retirement Accounts

If you haven't hit the 401(k) limit ($23,000 for 2024, likely higher for 2025), increase your contributions for the final few paychecks. Every dollar contributed reduces your taxable income dollar-for-dollar.

Harvest Investment Losses

Sell underperforming stocks to realize capital losses. You can use these losses to offset capital gains and up to $3,000 of ordinary income. This is known as "Tax Loss Harvesting."

defer Bonuses (If Possible)

If you expect to be in a lower tax bracket next year (e.g., retiring or taking a sabbatical), ask your employer if they can pay your year-end bonus in January instead of December.

Use Your FSA Funds

Flexible Spending Accounts are "use it or lose it." Schedule that dentist appointment, buy new glasses, or stock up on eligible health supplies before the deadline.

Frequently Asked Questions

What is the difference between marginal vs. effective tax rate?

Your marginal rate is the tax percentage applied to your last dollar earned (your highest bracket). Your effective rate is the actual percentage of your total income that went to the IRS (usually much lower).

Does this calculator include FICA taxes?

This calculator focuses on Federal and State income tax liability. It does not strictly calculate FICA (Social Security & Medicare) taxes, which are a flat 7.65% for most employees, though they are often part of your paycheck withholding.

Will I get a tax refund in 2025?

You only get a refund if your Withholdings (payments made from your paycheck) exceed your Total Tax Liability. If you underpaid throughout the year, you will owe money.

How much is the Standard Deduction for 2025?

Projected amounts are $15,000 for Single filers, $30,000 for Married Filing Jointly, and $22,500 for Heads of Household. These reduce your taxable income regardless of your expenses.

Does my state tax income?

Most states do, but 9 states (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming) have no state income tax. Our calculator allows you to input your specific state rate.

How are capital gains taxed compared to wages?

Short-term capital gains (assets held < 1 year) are taxed exactly like wages at your ordinary income tax rate. Long-term capital gains (held > 1 year) enjoy preferential rates of 0%, 15%, or 20%, depending on your income. This is why investing for the long term is so tax-efficient.

Can I pay my tax liability with a credit card?

Yes, but it comes with a catch. The IRS payment processors charge a processing fee (typically around 1.85% to 1.98%). It generally only makes sense if you are trying to hit a sign-up bonus on a new card that exceeds the fee cost.