Complete Guide: Texas Paycheck Laws & Taxes (2025)

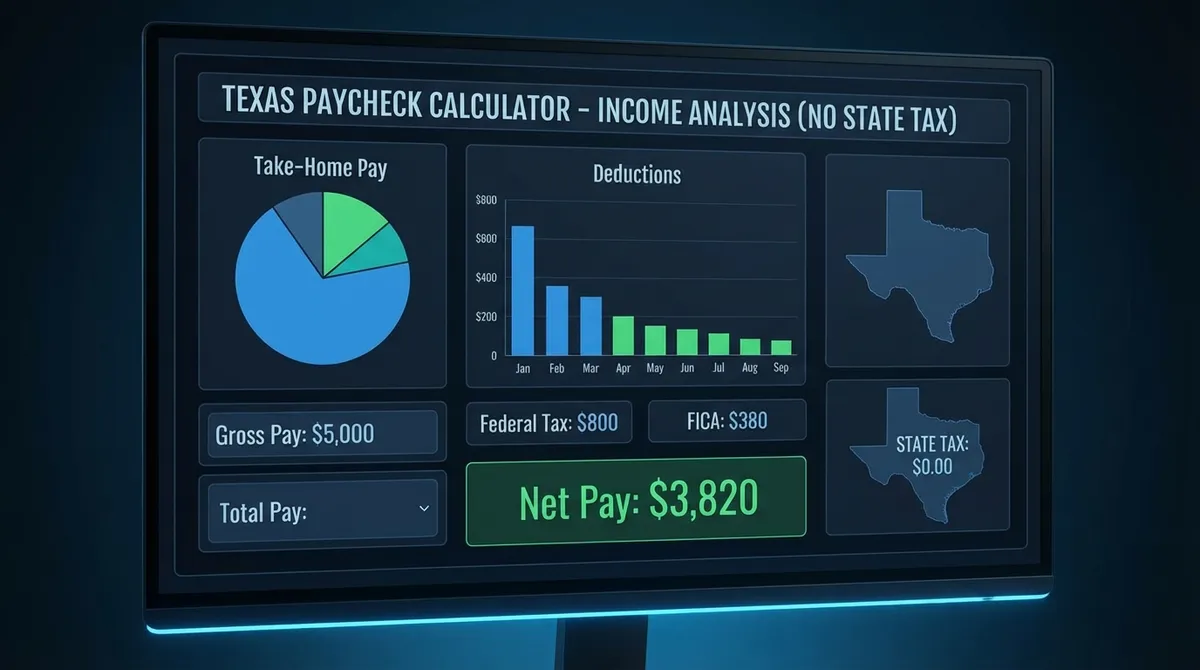

If you are living and working in Texas, you already have a significant financial advantage: Texas is one of only nine states with no state income tax. This means your "take-home pay" is generally higher in Texas than in states with heavy income tax burdens like California or New York.

However, your Texas paycheck is still subject to federal taxes. Understanding exactly what comes out of your check—from FICA to Federal Withholding—is key to accurate budgeting. This guide breaks down every component of your 2025 pay stub so you can verify your net pay and plan for your financial future.

1The "No State Income Tax" Advantage

The most unique feature of payroll in Texas is the absence of a state-level income tax line item. For a salary of $75,000, this saves a Texas resident approximately $2,000 to $4,000 per year compared to residents in states with average tax rates.

Federal Taxes: What You Still Pay

Even in Texas, Uncle Sam gets his share. Here are the three main deductions you will see on every paycheck:

1. Federal Income Tax

This is a progressive tax based on your annual income and filing status. In 2025, the tax brackets range from 10% to 37%. Use our Federal Income Tax Calculator to see where you fall.

- Progressive System: You only pay higher rates on the income that falls into higher brackets. For example, a single filer in 2025 pays only 10% on their first ~$11,925 of income.

- Withholding: Your employer calculates this based on the W-4 form you filled out. If you get a large refund every year, you are withholding too much; if you owe money, you are withholding too little.

2. Social Security Tax (FICA)

Social Security provides retirement and disability benefits.

- Rate: 6.2% of your gross wages.

- Wage Base Limit (2025): This tax only applies to the first $176,100 of your earnings. If you earn more than this, you stop paying Social Security tax for the rest of the year—a nice "raise" in your net pay towards the end of the year!

3. Medicare Tax (FICA)

Medicare funds health insurance for seniors.

- Rate: 1.45% of all your gross wages (no limit).

- Additional Tax: High earners (over $200k for single, $250k for married) pay an extra 0.9% surcharge on income above that threshold.

How to Maximize Your Take-Home Pay

Since you cannot change tax rates, the best way to lower your tax bill is through pre-tax deductions. These contributions come out of your gross pay before federal income tax is calculated.

💰 401(k) Contributions

In 2025, you can contribute up to $23,500 (projected) to a traditional 401(k). This lowers your taxable income dollar-for-dollar. Check your potential growth with our 401(k) Calculator.

🏥 HSA Contributions

Health Savings Accounts are triple-tax-advantaged. Contributions reduce taxable income, growth is tax-free, and spending on medical needs is tax-free.

Example: The $60,000 Texas Salary

Let's look at a realistic breakdown for a single filer living in Dallas or Houston earning $60,000 per year paid bi-weekly (26 paychecks). You can model your own scenario using our Salary Calculator.

| Component | Amount | Percent |

|---|---|---|

| Gross Pay | $2,307.69 | 100% |

| Federal Tax (Est.) | -$215.00 | ~9.3% |

| Social Security | -$143.08 | 6.2% |

| Medicare | -$33.46 | 1.45% |

| Net Pay | $1,916.15 | 83.0% |

*Note: This simplified example assumes a standard deduction and no other pre-tax contributions. Your actual withholding may vary.

Texas Payday Laws & Employee Rights

It is not just about taxes. Texas has specific employment laws, known as the "Texas Payday Law," enforced by the Texas Workforce Commission (TWC).

- Pay Frequency: Non-exempt (hourly) employees must be paid at least twice a month. See our Hourly Paycheck Calculator for details. Exempt (salaried) employees must be paid at least once a month.

- Final Paychecks: If you are laid off or fired, your employer must pay you in full within 6 calendar days. If you quit, you must be paid by the next regularly scheduled payday.

- Wage Deductions: Employers cannot deduct the cost of uniforms, tools, or shortages from your paycheck if it drops your pay below minimum wage, unless you have given written authorization.

Texas Wage Garnishment Laws

One area where Texas law is particularly unique—and protective of employees—is wage garnishment.

The Texas Constitution prohibits the garnishment of current wages for most debts. This means that a credit card company, hospital, or collection agency cannot garnish your paycheck in Texas, even if they have a court judgment against you.

However, there are three major exceptions where your wages can be garnished:

- Court-Ordered Child Support & Alimony: This is the most common reason. Employers are legally required to withhold these payments if ordered by a court or the Attorney General's office.

- Unpaid Student Loans: The U.S. Department of Education can garnish wages for defaulted federal student loans without a court order.

- Unpaid Taxes: The IRS can levy your wages for unpaid federal income taxes.

Tipped Employees: The $2.13 Rule

If you work in the service industry (waiters, bartenders), your paycheck looks very different due to the "Tip Credit."

- Cash Wage: Texas employers can pay tipped employees a cash wage as low as $2.13 per hour, as long as that amount plus tips equals at least the federal minimum wage of $7.25 per hour.

- Tip Pooling: Employers can require you to share tips with other "front of house" staff (like bussers and hosts), but managers and owners are prohibited from legally keeping any portion of your tips.

- Credit Card Fees: In Texas, employers are allowed to deduct the credit card processing fee (usually ~2-3%) from the tips charged on a credit card, though many choose not to.

Deep Dive: Understanding Your Pay Stub Codes

Pay stubs can be confusing alphabetical soup. Here is a glossary of common codes you might see on a Texas pay stub:

Earnings Codes

- REG (Regular Pay): Your standard hours × base rate.

- OT (Overtime): Hours worked over 40 (paid at 1.5x).

- HOL (Holiday Pay): Pay for holidays defined by your company.

- PTO/VAC: Paid Time Off or Vacation hours used.

- COMM (Commission): Performance-based earnings.

- BON (Bonus): Discretionary or performance bonuses.

Deduction Codes

- FIT/FED: Federal Income Tax withholding.

- SS/OASDI: Social Security Tax (6.2%).

- MED: Medicare Tax (1.45%).

- 401k: Retirement contribution (pre-tax).

- DENT/VIS/MED: Health, Dental, Vision insurance premiums.

- LTD/STD: Long-Term / Short-Term Disability insurance.

Strategic Move: The "Texas Zero" Strategy

For high earners moving to Texas from California or New York, the "Texas Zero" strategy involves optimizing your W-4 to break even.

When you move, your federal tax bracket doesn't change, but your deduction availability does. You lose the ability to deduct massive state income taxes on your federal return (though the $10k SALT cap often made this moot anyway).

Step 1: Recalculate your W-4 using a "Single" or "Married Filing Jointly" status without extra withholding unless you have significant non-wage income (interest, dividends).

Step 2: Redirect the 5-13% of income you used to pay in state taxes directly into a brokerage account or backdoor Roth IRA. DO NOT absorb it into lifestyle creep.

Example: Saving that 9.3% California tax on a $150k salary ($13,950/year) and investing it in an S&P 500 index fund (avg 10% return) grows to over $230,000 in just 10 years. That is the true power of the Texas paycheck. Use our Inflation Calculator to see how much that future sum is worth in today's dollars.

Are you truly an employee? The gig economy has made this distinction fuzzy, but the tax implications are huge.

W-2 Employee

- Taxes are withheld automatically.

- Employer pays half of FICA taxes.

- Eligible for overtime and unemployment benefits.

1099 Independent Contractor

- No taxes withheld—you get a check for the full gross amount.

- Self-Employment Tax: You must pay the full 15.3% FICA tax yourself (both the employer and employee share).

- You must pay quarterly estimated taxes to the IRS to avoid penalties.

Frequently Asked Questions

Why is my first paycheck of the year smaller?

It shouldn't be, unless you received a bonus that was taxed at a higher supplemental rate (22%), or your benefits premiums increased for the new year.

Do overtime laws apply in Texas?

Yes. Texas follows federal FLSA laws. Non-exempt employees get paid 1.5x their regular rate for any hours worked over 40 in a single workweek.

Is tip income taxable in Texas?

Yes, tips are considered taxable income for federal tax purposes. You must report them to your employer, and they are subject to Income Tax, Social Security, and Medicare withholding.