Texas: The Ultimate Tax-Friendly State in 2025

Texas stands as one of America's most financially attractive states, earning its reputation as a taxpayer's paradise. With absolutely no state income tax, Texas residents keep significantly more of their hard-earned money compared to states like California (13.3% top rate), New York (10.9%), or New Jersey (10.75%). This fundamental advantage makes Texas a magnet for businesses, retirees, and ambitious professionals seeking to maximize their take-home pay.

The Lone Star State's tax philosophy prioritizes economic growth and individual prosperity over government revenue maximization. While Texas does collect revenue through other means—primarily property taxes and sales taxes—the absence of state income tax creates an immediate and substantial financial benefit for every working Texan. Our 2025 Texas Tax Calculator reveals exactly how much you save compared to high-tax states and helps you understand where your money goes.

Key Financial Advantage:

A Texas resident earning $75,000 annually saves $3,750-$4,125 per year compared to living in a state with a 5-5.5% income tax rate. Over a 30-year career, this difference compounds to over $270,000 in additional take-home pay—not including investment returns.

Real Impact: This extra income could fund an additional $500,000 in retirement savings through compound interest, fundamentally transforming your financial independence timeline. Plan your savings with our Budget Calculator.

Understanding Texas's complete tax landscape empowers you to make informed financial decisions. While the state income tax advantage is clear, property taxes and sales taxes require strategic planning. This comprehensive guide breaks down everything you need to know about Texas taxes in 2025, from payroll withholdings to property tax exemptions that can save you thousands.

The Trade-Off: Property Taxes Explained

If there is no income tax, how does Texas pay for schools, roads, and police? The answer lies largely in property taxes. Texas has some of the highest effective property tax rates in the nation, typically ranking between 3rd and 7th highest.

Key Facts for Homeowners:

- Average Rate: The average effective rate is around 1.6% to 1.8%, but this varies wildly by county and school district. In some new developments (MUDs), rates can exceed 2.5%.

- Assessment: Homes are appraised at 100% of market value. If your home value skyrockets, so does your tax bill.

- The Silver Lining (Homestead Exemption): Texas offers a robust "Homestead Exemption" for primary residences. In 2023, voters approved an increase to the school district exemption, raising it to $100,000. This subtracts $100k from your home's taxable value for school tax purposes, saving most homeowners over $1,000 annually. Calculate your potential costs with our Property Tax Calculator.

Renters beware: While you don't receive a tax bill directly, high property taxes are baked into your rent payments. Landlords pass these costs on to tenants.

Sales & Use Tax: What You Pay at the Register

Consumption taxes are the other major revenue stream.

- State Rate: The base sales tax rate is 6.25%. Estimate your spending tax with our Sales Tax Calculator.

- Local Rate: Cities, counties, and transit authorities can add up to 2.00%, capping the total possible sales tax at 8.25%. Most major areas (Houston, Dallas, Austin, San Antonio) are at this 8.25% cap. Verify rates at the Texas Comptroller website.

- Exemptions: To help low-income families, Texas exempts "necessities" from sales tax. This includes groceries (unprepared food), prescription medicine, and over-the-counter drugs.

Hidden Costs: Sin Taxes & Tourism Taxes

While the general sales tax is 8.25%, other specific taxes can catch newcomers by surprise.

Texas Sales Tax Holiday

Good News: Every August (before school starts), Texas holds a tax-free weekend. You can buy clothing, footwear, school supplies, and backpacks (priced under $100) completely tax-free. This saves families millions annually.

"Sin" Taxes

Bad News: If you smoke or drink, you pay more.

• Cigarettes: $1.41 per pack state tax.

• Alcohol: Mixed beverage gross receipts tax is 6.7% (on top of sales tax!).

The Airbnb / Hotel Tax

Planning to run an Airbnb? Beware the Hotel Occupancy Tax. The state charges 6%, but local cities/counties can add another 7-9%. In cities like Austin or San Antonio, your total tax on a short-term rental can exceed 15-17%.

Don't Forget Federal Taxes

Just because Texas doesn't tax your income doesn't mean the IRS won't. You are still subject to the full federal tax brackets, ranging from 10% to 37%, plus FICA taxes (7.65%). Use our Income Tax Calculator to estimate your federal liability.

However, living in a no-tax state affects your federal return deduction strategy. Since the 2017 Tax Cuts and Jobs Act (TCJA) capped the State and Local Tax (SALT) deduction at $10,000, residents of high-tax states get screwed—they can't deduct their massive state income taxes. Texas residents, however, primarily deduct property taxes. The $10,000 SALT cap is less punitive here than in New York or California, where state income taxes alone often exceed the cap before even considering property taxes.

Common Texas Tax Mistakes That Cost You Money

Even in a tax-friendly state like Texas, costly mistakes can erode your financial advantage. Avoid these common errors to maximize your take-home pay and long-term wealth.

Mistake 1: Not Filing Homestead Exemption

Cost: $500-$1,000 per year in unnecessary property taxes.

Solution: File your homestead exemption immediately after closing on your primary residence. The application is free and available through your county appraisal district.

Mistake 2: Ignoring Property Tax Protest Deadlines

Cost: Hundreds or thousands of dollars in over-assessed property values.

Solution: Mark your calendar for April-May protest deadlines. Gather comparable sales data and protest annually—successful protests save money every subsequent year.

Mistake 3: Under-withholding Federal Taxes

Impact: Large tax bill in April or IRS penalties.

Solution: Use the IRS Tax Withholding Estimator annually, especially after life changes. Adjust your W-4 to optimize take-home pay without creating a tax liability.

Mistake 4: Not Maximizing Roth Accounts

Cost: Missing out on federal tax-free growth when you have no state tax benefit to lose.

Solution: Prioritize Roth IRA and Roth 401(k) contributions over traditional accounts. In Texas, Roth contributions cost you nothing at the state level (since tax is 0%) while providing federal tax-free retirement income.

The Great Texas Migration: Why Americans Are Moving to the Lone Star State

Texas has become America's top destination for domestic migration, with thousands of families and businesses relocating annually. The state's tax policy plays a starring role in this demographic shift, offering a compelling financial advantage that's hard to ignore.

2025 Migration Statistics

Net population gain (2024-2025)

Top destination state

Cite taxes as primary reason for moving

California vs. Texas: The Tax Gap Widens

California's top income tax rate of 13.3% creates a massive incentive for high earners to relocate. A tech worker earning $150,000 saves approximately $19,950 annually by moving from California to Texas. Analyze the return on this move with our ROI Calculator.

10-Year Tax Comparison: $150,000 Income

California

Texas

Texas Savings Over 10 Years: $112,500 ($11,250 annually)

How to Handle Texas Property Taxes: A Step-by-Step Guide

Since property taxes are the "price of admission" for living in Texas, managing them effectively is crucial. The process works on an annual cycle that every homeowner should memorize.

- 1

Jan 1: Valuation Date

Your home's value for tax purposes is set based on its condition on this date. If your house burns down on Jan 2, you still owe taxes on the full value for that year.

- 2

April - May: Notice of Appraised Value

You receive a letter from your County Appraisal District (CAD) stating what they think your home is worth. Do not ignore this. If it's too high, you must protest.

- 3

May 15: Protest Deadline

This is usually the deadline to file a "Notice of Protest." You can do this online easily. Protesting is the #1 way to lower your tax bill.

- 4

October: Tax Rates Set

Local taxing units (city, school, county) hold hearings and set the actual tax rates (e.g., $0.45 per $100 value).

- 5

Jan 31 (Next Year): Payment Deadline

Taxes are due. If you haven't paid by Jan 31, you face steep penalties and interest starting Feb 1.

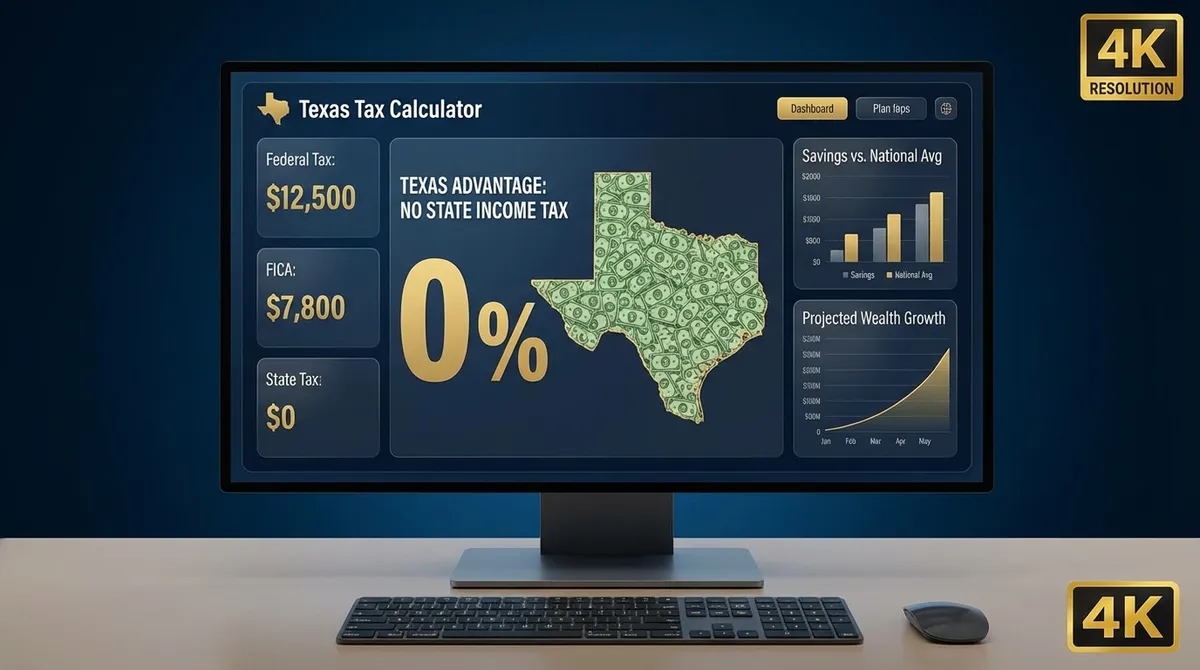

Image: Texas Tax Calculator - Understanding your tax savings in the Lone Star State

🎯 When to Use Related Tax & Payroll Calculators

Paycheck Calculator:

Use when you want to see exact withholdings per pay period (weekly, biweekly, monthly) and understand how pre-tax deductions affect your take-home pay.

401(k) Calculator:

Perfect for determining optimal contribution amounts to maximize both federal tax savings and employer matching in Texas's no-income-tax environment.

Federal Income Tax Calculator:

Essential for detailed federal tax planning, especially when considering Roth vs. traditional retirement contributions and itemized deductions.

Investment Calculator:

Calculate how much your Texas tax savings can grow through compound interest over time—turning today's savings into tomorrow's wealth.