Complete Guide: Understanding Traditional IRAs and Maximizing Your Retirement Savings in 2025

A Traditional Individual Retirement Account (IRA) remains one of the most powerful tools for building retirement savings while enjoying immediate tax benefits. In 2025, understanding how to maximize your Traditional IRA contributions—and the resulting tax advantages—can significantly impact your long-term financial security. Whether you're just starting your career or approaching retirement, this comprehensive guide will help you navigate the complexities of Traditional IRAs and make informed decisions about your retirement strategy.

What is a Traditional IRA?

A Traditional IRA is a tax-advantaged retirement savings account that allows individuals to contribute pre-tax dollars (up to certain limits) that can grow tax-deferred until withdrawal in retirement. Established in 1974, Traditional IRAs have helped millions of Americans build retirement savings while reducing their current tax burden.

The key distinguishing feature of a Traditional IRA is the potential for tax-deductible contributions. Depending on your income level, filing status, and whether you're covered by an employer retirement plan, your contributions may be fully, partially, or not deductible on your current year tax return. However, even non-deductible contributions benefit from tax-deferred growth.

2025 Traditional IRA Contribution Limits

The IRS sets annual contribution limits for Traditional IRAs, which are adjusted periodically for inflation. For 2025, the contribution limits are:

- Under age 50: $7,000 maximum annual contribution

- Age 50 and older: $8,000 maximum annual contribution (includes $1,000 catch-up contribution)

It's crucial to understand that this $7,000/$8,000 limit applies to the total combined contributions across all your Traditional and Roth IRAs. You cannot contribute $7,000 to a Traditional IRA and another $7,000 to a Roth IRA in the same year.

Additionally, you must have earned income (such as wages, salaries, or self-employment income) equal to or greater than your IRA contribution. The contribution deadline for each tax year is typically April 15 of the following year. For 2025 contributions, the deadline is April 15, 2026.

Understanding Traditional IRA Tax Deductibility

One of the most significant benefits of Traditional IRAs is the potential for tax-deductible contributions. However, not everyone can deduct their full contribution. The deductibility rules depend on three factors:

1. Your Income Level

The IRS uses your Modified Adjusted Gross Income (MAGI) to determine deduction eligibility. MAGI is essentially your adjusted gross income with certain deductions added back in.

2. Your Filing Status

Different income limits apply based on whether you file as single, married filing jointly, married filing separately, or head of household.

3. Employer Plan Coverage

If you (or your spouse) are not covered by an employer retirement plan (such as a 401(k), 403(b), or pension), you can take the full Traditional IRA deduction regardless of your income level.

2025 Income Limits for Traditional IRA Deductibility

If you ARE covered by an employer retirement plan:

- Single filers: Full deduction if MAGI is $78,000 or less; partial deduction if MAGI is between $78,000 and $88,000; no deduction if MAGI is $88,000 or more

- Married filing jointly: Full deduction if MAGI is $116,000 or less; partial deduction if MAGI is between $116,000 and $136,000; no deduction if MAGI is $136,000 or more

- Married filing separately: Partial deduction if MAGI is less than $10,000; no deduction if MAGI is $10,000 or more

Traditional IRA vs. Roth IRA: Key Differences

Understanding the differences between Traditional and Roth IRAs is essential for making informed retirement savings decisions. Both accounts share the same contribution limits but differ significantly in their tax treatment. Compare them with our Roth IRA Calculator.

Traditional IRA Advantages:

- Immediate Tax Benefits: Potentially deductible contributions reduce your current-year taxable income

- Tax-Deferred Growth: Investments grow without annual taxation on dividends, interest, or capital gains

- No Income Limits for Contributions: Anyone with earned income can contribute

- Lower Tax Bracket in Retirement: If you expect to be in a lower tax bracket when you retire, Traditional IRAs may be more advantageous. Check your current bracket with our Tax Bracket Calculator.

Roth IRA Advantages:

- Tax-Free Withdrawals: Qualified withdrawals in retirement are completely tax-free

- No Required Minimum Distributions: No RMDs during your lifetime (starting in 2024)

- Estate Planning: Can be passed to heirs tax-free

- Contribution Withdrawals: Can withdraw contributions anytime without taxes or penalties

Strategies for Maximizing Traditional IRA Benefits

1. Start Early and Contribute Consistently

The power of compound interest works best over long periods. Starting contributions early in your career—even small amounts—and maintaining consistent contributions can result in substantial retirement savings. Even non-deductible contributions benefit from tax-deferred growth.

2. Consider a "Backdoor Roth" Strategy

High-income earners who exceed Roth IRA contribution limits can contribute to a non-deductible Traditional IRA and immediately convert it to a Roth IRA. This strategy, known as a "backdoor Roth IRA," allows you to fund a Roth IRA regardless of income level. However, be aware of the pro-rata rule if you have existing Traditional IRA balances.

3. Coordinate with Employer Plans

If you have access to an employer retirement plan with matching contributions, prioritize contributing enough to receive the full employer match before maximizing IRA contributions. Employer matches represent immediate 100% returns that shouldn't be left on the table. Optimize your strategy with our SIMPLE IRA Calculator.

4. Tax Loss Harvesting in Taxable Accounts

If you have taxable investment accounts, consider tax loss harvesting to offset gains and reduce your taxable income. Lower income may improve your eligibility for deductible Traditional IRA contributions.

5. Convert to Roth During Low-Income Years

Consider converting Traditional IRA assets to Roth IRA during years when your income is temporarily low (e.g., career transition, early retirement before Social Security). You'll pay taxes at lower rates, and future growth becomes tax-free.

Common Traditional IRA Mistakes to Avoid

1. Missing the Contribution Deadline

Many people wait until the last minute to make IRA contributions. While the deadline is typically April 15, contributing earlier gives your money more time to grow and compound. Consider setting up automatic monthly contributions instead of annual lump sums.

2. Exceeding Contribution Limits

Contributing more than the annual limit results in a 6% excess contribution penalty. Track your contributions across all IRA accounts carefully. If you discover an excess contribution, correct it before your tax filing deadline to avoid penalties.

3. Missing Out on Catch-Up Contributions

If you're age 50 or older, you're eligible for an additional $1,000 catch-up contribution. Many people forget to take advantage of this, leaving valuable retirement savings and tax benefits on the table.

4. Not Considering Spousal IRAs

Non-working spouses can contribute to a Traditional IRA based on the working spouse's income. A couple where one spouse doesn't work can contribute up to $14,000-$16,000 annually to IRAs (depending on their ages), maximizing their tax-advantaged savings.

5. Forgetting Required Minimum Distributions

Starting at age 73, you must begin taking RMDs from your Traditional IRA. Failing to take the required distribution results in a harsh 50% penalty on the amount you should have withdrawn. The penalty dropped to 25% starting in 2023, and can be further reduced to 10% if corrected quickly.

Planning for Required Minimum Distributions (RMDs)

Understanding RMDs is crucial for Traditional IRA planning. Starting at age 73 (as of 2023), you must begin withdrawing a minimum amount from your Traditional IRA each year. The amount is calculated based on your account balance at the end of the previous year and your life expectancy factor from IRS tables. Calculate yours with our RMD Calculator.

RMDs are taxed as ordinary income, which can significantly impact your tax situation in retirement. Planning strategies include:

- Converting portions to Roth IRA before RMD age to reduce future RMDs

- Using RMDs for charitable giving through Qualified Charitable Distributions (QCDs)

- Coordinating RMDs with Social Security claiming strategies

- Managing tax brackets by balancing Traditional IRA withdrawals with other income sources

Key Takeaways

Traditional IRAs remain a cornerstone of retirement planning, offering immediate tax benefits and tax-deferred growth. By understanding the 2025 contribution limits, income restrictions on deductions, and strategic planning opportunities, you can maximize the benefits of your Traditional IRA.

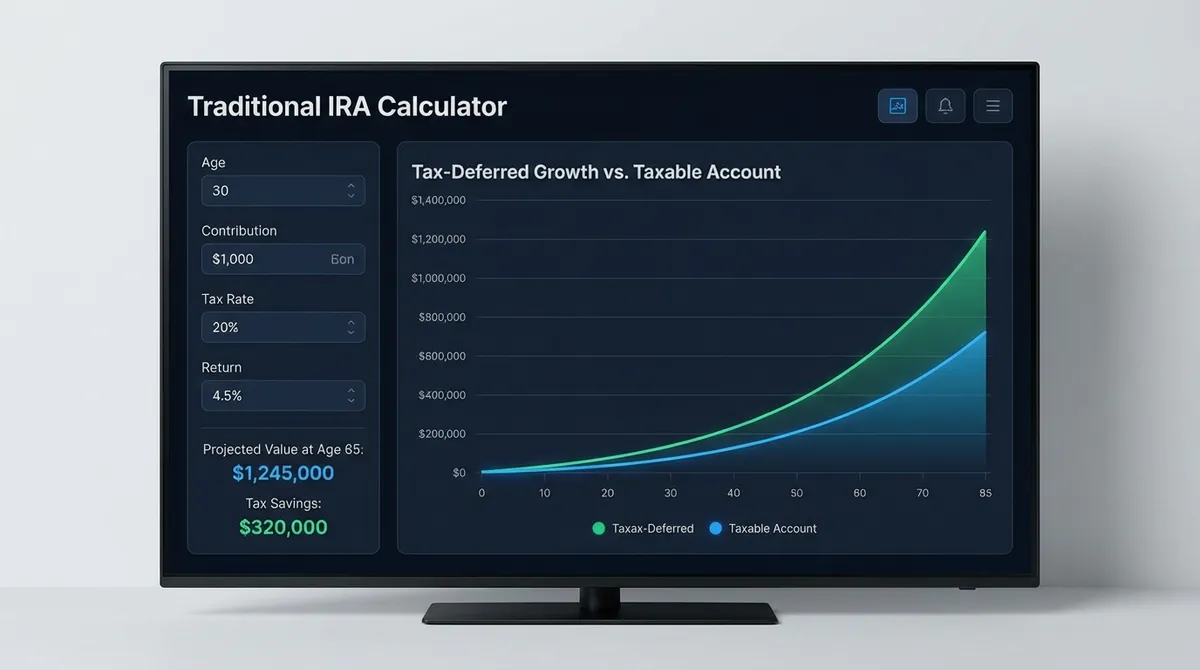

The key is to start early, contribute consistently, and stay informed about tax law changes. Use our Traditional IRA calculator above to model different scenarios and plan your retirement savings strategy effectively. Remember that while Traditional IRAs offer significant tax advantages, they're most effective when used as part of a comprehensive Retirement Plan that may include employer plans, Roth accounts, and taxable investments.

Whether you prioritize immediate tax deductions or future tax-free growth will depend on your unique financial situation, current and expected future tax rates, and overall retirement goals. Consulting with a qualified financial advisor or tax professional can help you make the best decision for your specific circumstances.