Washington Paycheck: The 2025 Guide

Living in Washington feels like you've unlocked a financial cheat code: Zero State Income Tax. While your friends in Oregon lose nearly 9% of their paycheck to the state, you keep that money. But before you plan that boat purchase, there's a catch—Washington has some unique payroll deductions (like the WA Cares Fund) that can surprise you.

Whether you just landed a job at Amazon, are opening a coffee shop in Spokane, or are just double-checking your pay stub, this guide breaks down exactly where your money goes in 2025.

The "No Income Tax" Advantage

Washington is one of only nine states with NO state income tax on wages. For a single filer earning $80,000, this saves you approximately $4,500 to $6,500 per year compared to living in neighboring states with high income taxes. That's a built-in 6-8% raise just for living here.

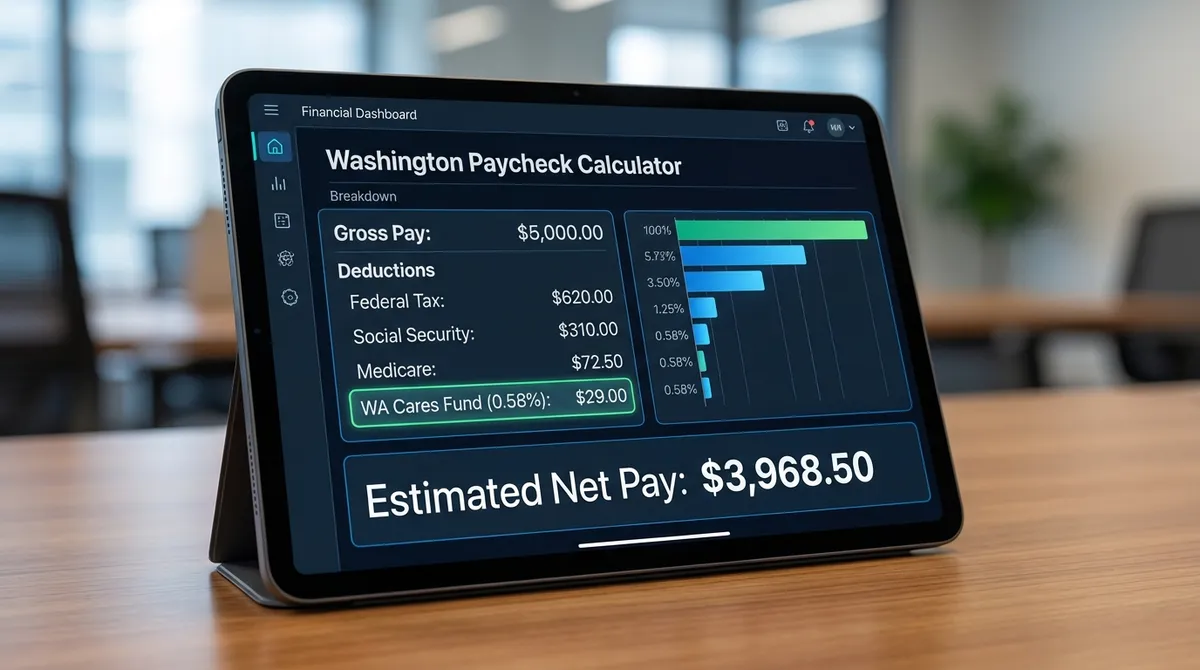

What Comes Out of Your Paycheck in 2025?

Even without a state income tax, your paycheck isn't untouched. You still face federal taxes and two specific Washington state premiums.

Federal Taxes

- Income Tax10% - 37%

- Social Security6.2%

- Medicare1.45%

WA State Premiums

- WA Cares Fund0.58%

- Paid Family Leave~0.66%

- State Income Tax0.00%

1. WA Cares Fund (0.58%)

This is Washington's mandatory long-term care insurance benefit. In 2025, 0.58% of your gross wages are deducted.

- No Cap: Unlike Social Security, there is no wage cap. If you earn $500,000, you pay tax on all of it.

- Benefit: Eligible workers can access up to $36,500 (adjusted for inflation) for long-term care services tailored to help them live independently.

- Exemptions: If you purchased private long-term care insurance before Nov 1, 2021, and applied for an exemption, you might not see this deduction.

2. Paid Family & Medical Leave (PFML) (~0.66%)

Washington has one of the best paid leave programs in the US. The premium is roughly 0.92% of your gross wages (up to the Social Security cap of $176,100), which impacts your take home pay.

How Are Bonuses Taxed in WA?

If you receive a signing bonus or annual performance bonus, you might notice a larger chunk missing. This is due to the IRS Supplemental Wage Tax Rate.

- Flat 22%: For bonuses under $1 million, employers typically withhold a flat 22% for federal income tax (plus 6.2% SS + 1.45% Medicare + 0.58% WA Cares + 0.66% PFML).

- It's a Withholding, Not a Tax: The 22% is just an estimate. Your actual tax liability depends on your total annual income. If 22% was too high, you'll get the difference back in your refund. If you are in the 32% tax bracket, you might actually owe more in April.

RSUs and Stock Options

For Seattle tech workers (Amazon, Microsoft, etc.), Restricted Stock Units (RSUs) are a huge part of compensation. They affect your annual income.

Vesting = Income

Rule of thumb: Vesting is treated exactly like cash salary. On the day your RSUs vest, their total value is added to your W-2 wages and taxed at the supplemental rate (usually 22%).

The "Sell to Cover" Transaction

Most companies automatically sell about 30-40% of your shares immediately upon vesting to pay the taxes. You receive the remaining shares in your brokerage account.

Note: Washington Capital Gains Tax (7%) applies only to the growth of the stock after you receive it, and only if gains exceed $262,000. It does not apply to the initial vesting value.

Understanding Your Pay Stub

Reading a pay stub can feel like deciphering a secret code. Here are the key terms you need to know:

Gross Pay

The big number at the top. This is your hourly rate × hours worked, or your salary divided by pay periods.

Pre-Tax Deductions

Money taken out before federal taxes are calculated. This lowers your taxable income.

- 401(k) / 403(b) Contributions

- Health Insurance Premiums (Medical/Dental)

- HSA / FSA Contributions

Post-Tax Deductions

Money taken out after taxes. This includes Roth 401(k) contributions, wage garnishments, and life insurance.

Net Pay

The actual amount that hits your bank account.

Minimum Wage & Overtime (2025)

Washington consistently has one of the highest minimum wages in the country, adjusted annually for inflation.

| Area | 2025 Minimum Wage | Notes |

|---|---|---|

| Washington State (Standard) | $16.66/hr | Applies everywhere unless a city has a higher rate. |

| Seattle | $20.76/hr | One of the highest in the US. Specific rules for small employers. |

| SeaTac (Hospitality/Transport) | $20.00+/hr | Adjusted annually for workers in/near the airport. |

| Tukwila | $20.00+/hr | Often higher than the state minimum. |

Overtime Rules

In Washington, if you work more than 40 hours in a 7-day workweek, you are entitled to 1.5x your regular rate. This applies to most hourly workers. Salaried employees earning below specific thresholds (approx. $67,724 in 2024-25, check L&I for updates) may also be eligible for overtime.

Real-World Example: $75,000 Salary

Let's say you're a Graphic Designer in Seattle earning $75,000 per year. You are single and claim the standard deduction. Here is your estimated 2025 breakdown:

| Tax / Deduction | Annual Amount | % of Pay |

|---|---|---|

| Federal Income Tax | -$8,450 | 11.3% |

| Social Security | -$4,650 | 6.2% |

| Medicare | -$1,088 | 1.45% |

| WA Cares Fund | -$435 | 0.58% |

| WA PFML | -$495 | 0.66% |

| Net Take-Home Pay | $59,882 | 79.8% |

*Estimates based on 2025 tax brackets and standard deductions. Actual pay may vary by employer.

Self-Employed vs. Employee in WA

The tax landscape changes strictly when you leave the W-2 world.

W-2 Employees

- Employer pays half of Social Security & Medicare (7.65%).

- Employer pays some WA PFML premiums.

- B&O Tax does not apply to you.

Self-Employed / Freelancers

- You pay the full 15.3% Self-Employment Tax (ignoring income tax).

- You must pay B&O Tax on gross receipts if you earn over $125,000/year.

- You can opt-in to WA PFML, but it's optional.

Hourly vs. Salary Calculator Math

Sometimes you need to convert a job offer to see the real number. Use a salary calculator.

The "2080" Rule

There are 52 weeks in a year. 52 weeks × 40 hours = 2,080 working hours per year.

- $50,000 Salary≈ $24.04 / hour

- $75,000 Salary≈ $36.06 / hour

- $100,000 Salary≈ $48.08 / hour

- $25 / hour≈ $52,000 / year

What About Garnishments?

If you have unpaid debts, a court might order a garnishment of your wages. Washington state law limits how much can be taken.

- Consumer Debt: Creditors can typically take no more than 20% of your disposable earnings (or the amount exceeding 35x the minimum wage, whichever is less).

- Child Support: This is prioritized. Up to 50-60% of your disposable income can be withheld.

- Student Loans: Federal loans can garnish up to 15% of your pay without a court order.

Frequently Asked Questions

Can I opt out of the WA Cares Fund?

Generally, no. The initial opt-out window set by the state has closed (it was Nov 2021). Unless you have a specific permanent exemption approved by the ESD (like being a 100% disabled veteran or living out of state while working in WA), you must pay the 0.58% premium.

Is the WA PFML premium capped?

Yes. The Paid Family & Medical Leave premium is only assessed on wages up to the Social Security wage base, which is $176,100 for 2025. Verify this on your pay stub if you are a high earner.

Do I pay tax on Capital Gains in Washington?

This is a tricky one. While there is no income tax, Washington introduced a 7% tax on capital gains exceeding $262,000 (adjusted for 2025) derived from the sale of long-term assets like stocks or bonds. This does not apply to real estate or retirement accounts.

The Bottom Line

Washington remains a tax haven for wage earners. By understanding the WA Cares and PFML deductions, you can better budget your monthly cash flow. Use our comprehensive, free calculator above to run unlimited custom scenarios—from raises and bonuses to changes in your 401(k) contributions—to see exactly what lands in your bank account today.