Complete Guide: Washington State Tax System (2025 Edition)

Washington offers one of the most distinctive tax environments in the United States. While residents enjoy zero state income tax on wages and salaries, the state balances this with higher sales taxes, a dedicated long-term care payroll tax (WA Cares Fund), and a specific capital gains tax for high earners. This guide breaks down exactly how Washington's tax system works in 2025 and how to estimate your complete liability.

The "No Income Tax" Advantage

For most residents, the headline benefit is clear: you keep more of your paycheck. Washington is one of only nine states with no personal income tax on earned income.

- Wages & Salaries: 0% tax. If you earn $100,000, you keep the full $100,000 (minus federal taxes and WA Cares).

- Retirement Income: 0% tax. Social Security, 401(k), and IRA withdrawals are state tax-free.

- Interest & Dividends: 0% tax. Standard investment income is not taxed at the state level.

The WA Cares Fund: A Mandatory Payroll Tax

Most Washington employees will see a deduction on their paycheck for the WA Cares Fund. This is a mandatory state-run long-term care insurance benefit.

- Rate: 0.58% of gross wages.

- Cap: None. It applies to all wages, including bonuses and stock options.

- Example: An employee earning $100,000 will pay $580 per year. An employee earning $250,000 will pay $1,450.

Note: Self-employed individuals are not required to participate but can opt-in. Employees who purchased private long-term care insurance before Nov 1, 2021, may have an approved exemption letter.

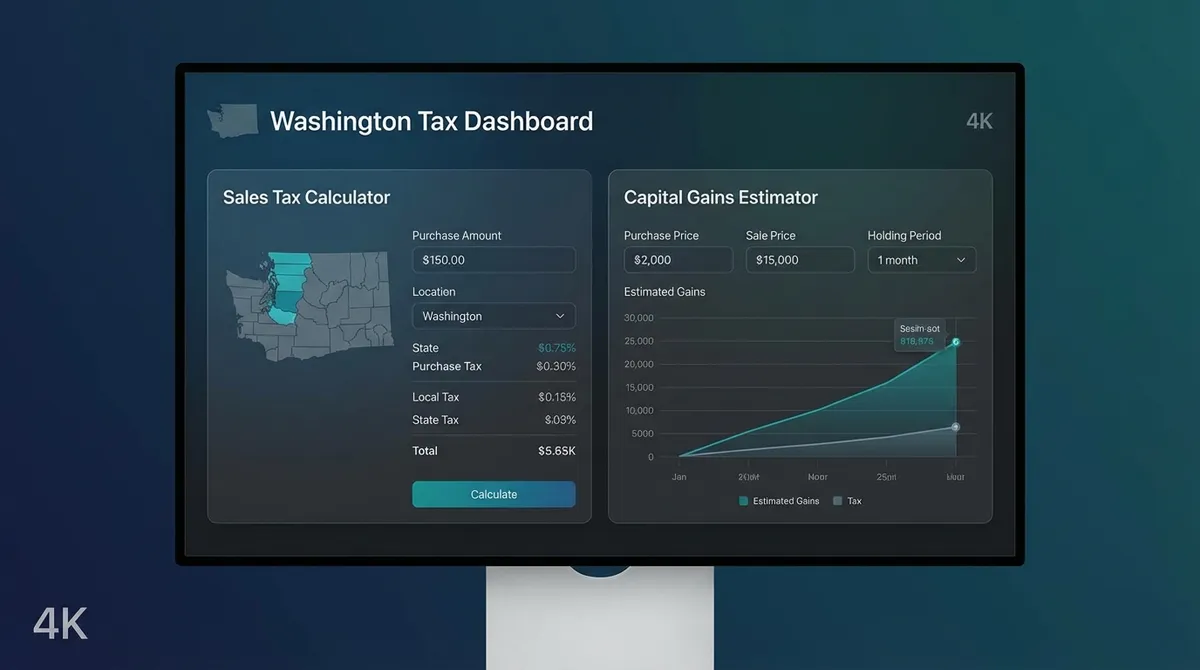

The Capital Gains Tax (High Earners)

Washington levies a 7% tax on long-term capital gains exceeding $262,000 (2025 estimate). This tax is highly targeted and affects very few residents.

What IS Taxed:

- Profits from selling stocks & bonds

- Business interest sales

- Tangible assets (artwork, collectibles)

What is EXEMPT (Not Taxed):

- Real estate sales (your home or rentals)

- Retirement accounts (401k, IRA, Roth)

- Qualified small business stock (QSBS)

- Commercial real estate

Business & Occupation (B&O) Tax: The Hidden Cost

Unlike most states that tax corporate profits (net income), Washington taxes gross receipts. This is called the Business & Occupation (B&O) Tax.

- Who pays? Almost every business operating in WA, including independent contractors, freelancers, and LLCs.

- The Rate: Varies by category. Retailing is often 0.471%, while services (consulting, coding, law) are taxed at 1.5% to 1.75% of gross revenue.

- Small Business Credit: If your annual gross income is under ~$125,000 (varies by classification), the Small Business Tax Credit may offset your entire liability, but you still usually need to file.

Washington Estate Tax (Death Tax)

Washington has the highest state estate tax rates in the nation, reaching up to 20%.

- Threshold: The tax applies to estates valued over $2.193 million. This threshold is NOT indexed for inflation, meaning rising home values pull more middle-class families into this tax bracket every year.

- Comparison: The federal exemption is over $13 million. Many families will owe zero federal estate tax but a significant Washington state tax.

Sales Tax: The Trade-Off

To fund state services without an income tax, Washington relies heavily on sales tax. The statewide base rate is 6.5%, but local jurisdictions can add up to 4% more.

| City | Total Rate | Tax on $1,000 |

|---|---|---|

| Seattle | 10.4% | $104.00 |

| Tacoma | 10.3% | $103.00 |

| Spokane | 9.0% | $90.00 |

| Vancouver | 8.5% | $85.00 |

Tip: Groceries (unprepared food) and prescription drugs are exempt from sales tax throughout the state.

Real World Scenario: The $100k Earner

Let's verify if moving to Washington saves money. Compare a single person earning $100,000 in Seattle vs. Portland, Oregon.

Seattle, WA

- State Income Tax: $0

- WA Cares Tax (0.58%): -$580

- Est. Sales Tax (on $30k spend): -$3,120

- Net State Levy: $3,700

Portland, OR

- State Income Tax (~8.75%): -$8,750

- Sales Tax (0%): $0

- Net State Levy: $8,750

🏆 Winner: Washington saves this earner approx. $5,050 per year even after the WA Cares tax.

Property Tax Dynamics

Washington's property tax system is budget-based. This means taxing districts request a specific dollar amount, and the rate adjusts based on total property values. The average effective rate is around 1.0%, which is near the national average.

Vehicle Excise Tax (RTA Tax)

If you live in the Sound Transit District (parts of King, Pierce, and Snohomish counties), registering your car is significantly more expensive due to the RTA (Regional Transit Authority) Tax.

How it works:

- Rate: 1.1% of the depreciated value of your vehicle.

- Valuation Controversy: The state uses an MSRP depreciation schedule that often values cars higher than their actual Blue Book market value, leading to artificially high tabs.

- Impact: A new $50,000 car could cost over $600/year just to register in Seattle or Bellevue.

Property Tax Exemptions (Seniors & Disabled)

Washington offers a robust property tax exemption program for senior citizens (age 61+) and people with disabilities.

Eligibility (2025 Estimates)

To qualify, you generally must:

- Be at least 61 years old by Dec 31 of the filing year, OR unable to work due to disability.

- Own and occupy your primary residence.

- Have a combined disposable income under the county threshold (e.g., ~$84,000 in King County, lower in others).

Benefit: This can freeze your property value and exempt you from all excess levies, potentially saving thousands per year.

Why Is There No Income Tax?

Washington's lack of an income tax isn't just an accident; it's a century-long battle.

In 1932, during the Great Depression, voters actually approved an income tax by initiative. However, the State Supreme Court struck it down in 1933, ruling that income is "property" and, under the state constitution, all property must be taxed uniformly (at the same rate). A progressive income tax (charging rich people more) was therefore unconstitutional.

Since then, voters have rejected income tax proposals 10 times at the ballot box including as recently as 2010. This strong voter sentiment has cemented the sales-tax-heavy model the state uses today.

Common Questions

Do I have to pay the WA Cares Fund tax?

If you are a W-2 employee in Washington, yes, unless you have an approved exemption letter from the Washington Department of Revenue or Employment Security Department. The rate is 0.58% of your gross wages with no income cap. You can estimate the impact on your net pay using our Take-Home Pay Calculator.

Does Washington tax my 401(k) or pension?

No. Washington is one of the most retirement-friendly states because it does not tax Social Security, pension income, or withdrawals from 401(k) and IRA accounts. However, you should still track your potential federal liabilities with a Tax Bracket Calculator to ensure you're setting aside enough for the IRS.

Do I have to file a state tax return in Washington?

Most residents do not file a state return. However, if you owe the Capital Gains Tax (gains over $262,000) or owe Business & Occupation (B&O) tax, you must file a return. Freelancers often need to pay B&O tax, which is different from the standard Self-Employment Tax paid to the federal government.

Can I deduct Washington sales tax on my federal return?

Yes! If you itemize deductions on your federal return (Schedule A), you can choose to deduct state sales tax instead of state income tax. Since Washington residents pay no income tax, deducting sales tax is a huge benefit. Our Sales Tax Calculator can help you estimate your total annual sales tax burden.

Is there a "Head Tax" or other hidden taxes?

Some cities, like Seattle, have a payroll expense tax (often called the "JumpStart Tax") paid by large employers. Employees receiving large sign-on bonuses should also use a Bonus Tax Calculator to see how much federal withholding will come out of their lump sum payments.

How does the Real Estate Excise Tax (REET) work?

When you sell a home in WA, you pay a graduated REET. For 2025, the rate starts at 1.1% on the first $525,000 of value and increases to 1.28% on the next tier. This is technically paid by the seller but affects the net proceeds of your home sale.

Does Washington have an inheritance tax?

It does not have an "inheritance" tax (tax on beneficiaries), but it has an "estate" tax (tax on the estate itself) for estates valued over $2.193 million.