Zero Based Budget Calculator

Stop wondering where your money went and start telling it where to go. A zero-based budget calculator is the ultimate tool for intentional spending. By allocating every single dollar of your income to a specific category—expenses, savings, debt, or giving—until you have exactly $0 left to assign, you take complete control of your financial life.

How This Zero-Based Budget Calculator Works

The Magic Formula

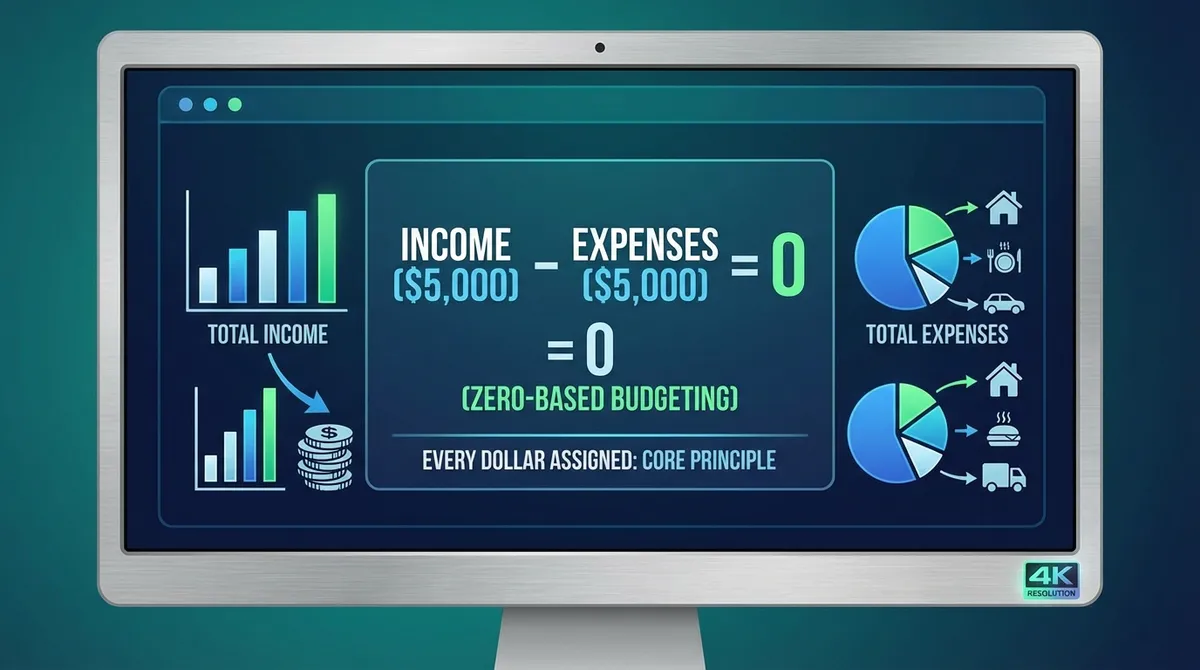

The math behind zero-based budgeting (ZBB) is simple but powerful. Unlike traditional budgeting where you just clear your bills and hope for leftovers, ZBB requires this exact equation:

If the result is positive (e.g., $200 remaining), your job isn't done—you must assign that $200 to savings or debt. If it's negative, you are living beyond your means and must cut costs.

What "Balanced" Means

A balanced budget doesn't mean you have zero dollars in your bank account. It means you have zero dollars unassigned. Every dollar has a specific purpose before the month begins.

Why It's Superior

This method eliminates "accidental spending." When you have to actively take money from your "Restaurant" category to fund a splurge, you become acutely aware of the trade-off.

Step-by-Step Guide to Zero-Based Budgeting

Calculate Your Total Monthly Income

Start with your net take-home pay. If you have a variable income (freelance, commissions), use the average of your last 3 lowest-earning months. This creates a safety buffer. Include everything: side hustles, child support, dividends, etc.

List Your "Four Walls" First

Before budgeting for Netflix or dining out, ensure your survival needs are covered. We call these the Four Walls:

- Food (Groceries only)

- Utilities (Lights & Water)

- Shelter (Rent/Mortgage)

- Transportation (Gas/Bus)

Assign the Rest (Debt, Savings, Fun)

Once basic needs are met, list everything else. Use the Debt Snowball Calculator to plan your payouts. Don't forget to allocate for your Net Worth Calculator.

Balance to Zero

This is the critical step. If your Income - Expenses equals $105, you need to assign that $105 to a category like Savings Goals. If it equals -$50, you must reduce a category.

Real World Example: The "Average" Family

Case StudyMeet Sarah and Mike. They bring home $5,000/month. Here is how they fail at traditional budgeting vs. how they succeed with zero-based budgeting.

The "Leftover" Approach

- Pay Bills: $3,500

- Buy Groceries: $600

- Random Spending: $900

- Savings: $0 (Oops)

Result: They wonder where their money went and save nothing.

The Intentional Approach

- Pay Bills: $3,500

- Grocery Budget: $600

- Fun Money: $400

- Savings Transfer: $500

- Unassigned: $0 (Perfect)

Result: They saved $500 and still enjoyed $400 of guilt-free fun.

The Philosophy of Zero-Based Budgeting

Zero-based budgeting (ZBB) is not just a method; it's a mindset shift. The core philosophy is that every dollar you earn has a job to do. When you leave money unassigned in your checking account, it tends to disappear into the "void" of impulse purchases—that extra coffee, the subscription you forgot to cancel, or the online sale you didn't need.

By forcing your budget to equal zero (Income - Expenses = $0), you become the CEO of your money. You are no longer wondering if you can afford something; your budget tells you exactly what is possible. It transforms money management from a passive activity ("I hope I have enough") to an active one ("I have allocated $X for this").

Why It Works Better Than Other Methods

- Intentionality: It prevents "mindless spending" because every transaction must be categorized against a finite allocation.

- Flexibility: It is not rigid. If you overspend on groceries, you simply move money from another category (like entertainment) to cover it. The zero balance remains.

- Goal-Oriented: It naturally prioritizes savings and debt payoff because these are treated as "expenses" that you pay to your future self.

- Clarity: It exposes exactly where your money is going, highlighting habits you may not have noticed (like spending $400/month on takeout).

Advanced Strategies for Success

1. The "Sinking Funds" Technique

A common reason budgets fail is irregular expenses. You budget for monthly bills, but then your car insurance comes due ($600) or Christmas arrives. Sinking funds solve this.

How to implement:

- List all annual expenses (e.g., Christmas $500, Car Registration $200).

- Divide the total by 12.

- Include this monthly amount in your zero-based budget as an expense.

- Move that cash to a separate savings account each month until the bill is due.

2. The "Cash Envelope" Hybrid

For categories where you constantly overspend (groceries, restaurants, personal money), use cash. When the cash is gone, you stop spending.

Digital Version: Use a separate debit card or checking account for these variable expenses. Transfer your budgeted amount there and only use that card for those specific purchases.

3. The Buffer Month

The ultimate goal of zero-based budgeting is to live on last month's income. This breaks the paycheck-to-paycheck cycle completely.

Accumulate one full month of expenses in your checking account. Then, when May 1st arrives, you budget using the income you earned in April. You know exactly how much you have before the month even starts—no guessing.

5 Common Mistakes That Kill Budgets

1. Forgetting "Sinking Funds"

Ignoring annual bills like Amazon Prime or Car Insurance. Divide them by 12 and save monthly so the bill doesn't surprise you.

2. Budgeting Too Tight

Don't set your grocery budget to $200 if you typically spend $600. Be realistic first, track your actual spending, then trim gradually over time.

3. Not Tracking Spending

A budget is just a wish list if you don't track. You must log expenses as they happen (daily or weekly) to know if you are on track.

4. Giving Up After One Month

It takes about 3 months to get your budget right. The first month is always a disaster. Don't quit; adjust the numbers and try again.

5. Leaving Money "Unassigned"

If you have $50 left over, assign it! If you don't give it a name (like "Extra Debt Payment"), it will vanish. Every dollar needs a name.

Frequently Asked Questions (FAQ)

What if my income varies every month?

If you are a freelancer or commissioned salesperson, budget based on your lowest likely income. If you usually make between $3,000 and $5,000, build your budget on $3,000. When you make extra, list it as "Extra Income" and immediately apply it to a specific goal like savings or debt reduction.

How often should I review my budget?

We recommend a weekly check-in. It takes 10 minutes. Review what you spent, update your tracking, and see how much is left in each category for the rest of the month. A daily check is even better for awareness.

What if unexpected expenses come up?

This is why you need a "Miscellaneous" category and an "Emergency Fund." For small surprises (like a school field trip), use the Miscellaneous buffer. For big ones (car repair), use your Emergency Fund. Adjust your budget immediately to reflect the reality.

Is this better than the 50/30/20 rule?

The Savings Calculator rule (50% needs, 30% wants, 20% savings) is a great guideline, but it's not a method of control. You can use zero-based budgeting to execute the 50/30/20 rule. For a perspective on long-term value, check our Inflation Calculator or read about making a budget at Consumer.gov.

Do I need special software?

No. You can use a simple spreadsheet, a notebook, or specialized apps like YNAB (You Need A Budget) or EveryDollar. The tool matters less than the behavior. Our calculator above helps you create that initial plan perfectly.

Start Your Financial Journey Today

The best time to start budgeting was yesterday. The second best time is today. A zero-based budget is the most powerful tool you can use to build wealth. It turns the lights on in a dark room, showing you exactly where you stand and how to get where you want to go.

Use the calculator at the top of this page to draft your first month. It might be messy, and that is okay. Stick with it for three months, and you will feel like you got a raise.